Proverbs 16:1

(LBLA): “Del hombre son los propósitos del corazón, mas del Señor es la respuesta de la lengua.”

(NKJV): “The preparations of the heart belong to man, But the answer of the tongue is from the LORD.”

(TPT): “Go ahead and make all the plans you want, but it’s the LORD who will ultimately direct your steps.”

Sources:

(1) https://www.investopedia.com/investing/know-your-shareholder-rights/

(2) Achievable Study Resources

(3) https://www.investopedia.com/terms/c/commonstock.asp

(4) https://www.nyse.com/index

(5) https://www.nasdaq.com/

(6) https://www.ice.com/equity-derivatives

(7) https://uniquestockgift.com/products/jp-morgan

(8)https://www.worldsfirststockexchange.com/2020/11/17/the-voc-and-amsterdams-first-exchange-building/

(9) https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.britannica.com%2Fmoney%2FNew-York-Stock-Exchange&psig=AOvVaw04xhrR1P_hqyvZD_ooWy3j&ust=1739826360451000&source=images&cd=vfe&opi=89978449&ved=0CBQQjRxqFwoTCODY5rWMyYsDFQAAAAAdAAAAABAE

(11) https://www.sec.gov/files/reada10k.pdf

(12) https://www.congress.gov/bill/107th-congress/house-bill/3763

(13) https://www.sec.gov/search-filings

(14) https://www.sec.gov/files/form10-q.pdf

(15) https://www.investor.gov/introduction-investing/investing-basics/glossary/form-10-q

(16) https://www.sec.gov/ix?doc=/Archives/edgar/data/37996/000003799624000185/f-20240930.htm

(17) https://www.investor.gov/introduction-investing/investing-basics/glossary/form-8-k

(18) https://www.investor.gov/introduction-investing/investing-basics/glossary/fair-disclosure-regulation-fd

(19) https://www.investor.gov/introduction-investing/investing-basics/glossary/transfer-agents#:~:text=Transfer%20agents%20work%20for%20the,as%20its%20own%20transfer%20agent.

(20) https://shareholder.ford.com/Investors/Information/faqs/default.aspx

(21) https://www.nasdaq.com/glossary/d/declaration-date

(22) https://corporatefinanceinstitute.com/resources/equities/important-dividend-dates/

(23) https://www.law.cornell.edu/wex/shareholder_derivative_suit

(24) https://www.investopedia.com/terms/s/shareholder.asp#:~:text=Some%20companies%20further,highest%20voting%20power.

(25) https://content.next.westlaw.com/practical-law/document/I3a9a104def1211e28578f7ccc38dcbee/Stockholders-Agreement-Right-of-First-Refusal?viewType=FullText&transitionType=Default&contextData=(sc.Default)#:~:text=(National%2FFederal)-,A%20standard%20clause%20in%20many%20stockholders%20agreements%20that%20requires%20a,them%20to%20the%20third%20party.

Common stockholders have the following rights:

Right #1: Right To Vote For Certain Actions

Right #2: Right To Inspect Books & Records

Right #3: Right To Transfer Ownership of Stock

Right #4: Right to Receive A Dividend IF Issued

Right #5: Right To Assets Upon Liquidation IF Any Is Leftover

Right #6: Right To Sue For Certain Wrongful Actions

Right #7: Right To Capital Appreciation When Share Is Sold

Right #8: Preemptive Right To Maintain Proportionate Ownership Levels

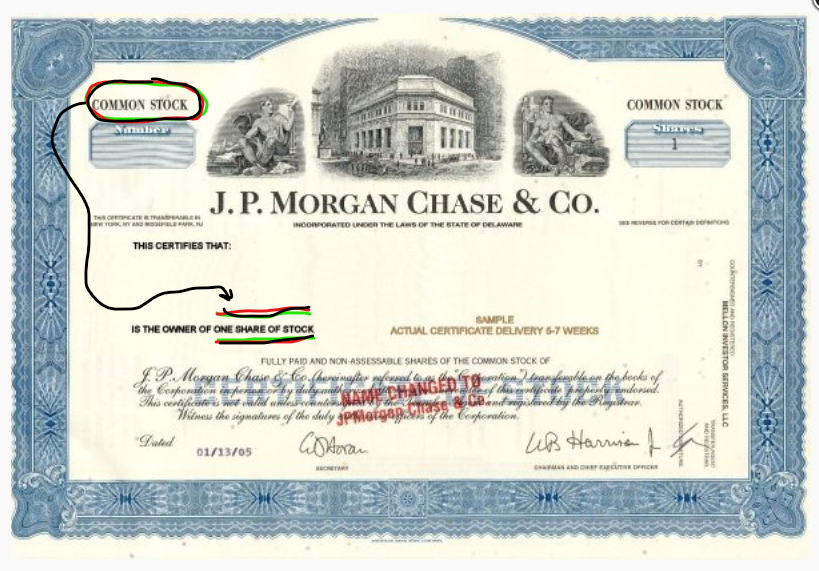

What Is Common Stock?

Common stock is a type of equitable security. A common stock provides equity because it grants a shareholder a percentage of ownership in the company. The shareholder is granted a residual claim to a percentage of the company’s assets & earnings leftover after the company’s obligations are met.

Owning common stock is not without certain risks. One of these risks is the liquidation of common stock during bankruptcy proceedings.

The first stock exchange is the Amsterdam Stock Exchange, founded in 1602 by the Dutch.

Today, many countries participate in the exchange of stocks. Large U.S.-based stocks, and their derivatives, are commonly exchanged at: NYSE, NASDAQ, & ICE.

What Are The Rights Of Common Stock Holders?

Right #1: Right To Vote For Certain Actions

Shareholders in a company’s common stock have the right to vote for certain matters of corporate policy.

Voting Structures

The number of votes a shareholder actually has usually depends on the amount of shares they own. Typically, one share equals one vote. However, some companies utilize Class A stock & Class B stock which can have different voting percentages.

There are usually only two voting structures in place for how these votes are cast: statutory or cumulative.

Statutory voting:

In a statutory voting scheme, the amount of Board of Director positions available, will impact how many votes can be cast per person running.

For instance, if a shareholder has 800 shares of stock, then they have 800 votes per open position.

If a company has four open positions for Board of Directors, then 800 votes is the maximum that can be given to each position.

800 x 4 = 3200 total votes. However, because there are four open positions, 3200 is divided by 4 for a total of 800 votes per open position.

These votes can not be combined in a statutory voting scheme.

Cumulative voting:

In contrast to statutory voting, the cumulative voting structure allows for the combined total to be split up in the way the voter sees fit. The shareholder can apply all of their votes to one open position, or split it up amongst all of the open positions.

For example: If a shareholder has 800 votes, and there are four board of director positions open, that shareholder has a total of 3200 votes. The shareholder can choose to give all 3200 votes to one board of director position. The shareholder can also choose to divide up those 3200 votes and vote for all four positions equally, similar to a statutory voting scheme.

Shareholders of record, get to vote on members of the board of directors, changes to the company’s charter & bylaws. Shareholders may also vote on dilutive actions like forward & reverse stock-splits.

Because of the distance most people have to annual shareholder meetings, most shareholders cast their vote by a proxy or a third party. The SEC requires companies to send an annual report to their shareholders when annual meetings are being held to elect their board of director positions.

Majority Control: Public vs. Private

In publicly held companies, shareholders can exert the majority of control in some cases. This allows shareholders to seriously influence the voting of directors in or out of the company.

In contrast, many privately-held companies have the majority of stock owned by officers & directors. Therefore, common shareholders may not have a majority vote, and thus may not be able to influence, who becomes a board of directors member, to any serious degree.

Right #2: Right To Inspect Books & Records

Stockholders of common stock can inspect the companies’ “books and records”. These books and records are often utilized to make wise investment decisions.

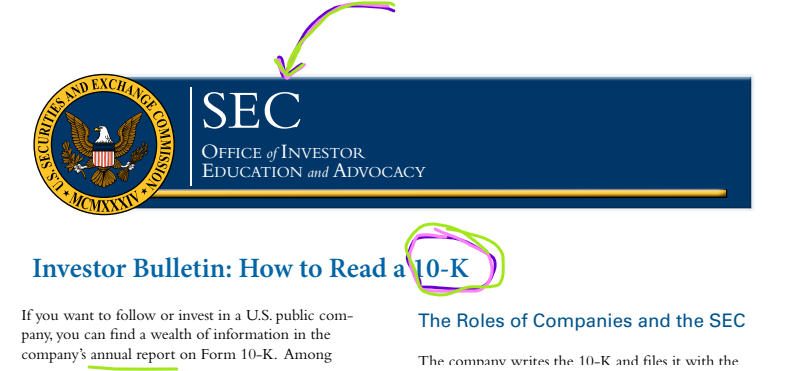

The Securities and Exchange Commission (SEC) has reporting requirements for the 10-K annual report, the 10-Q quarterly report, and Form 8-K.

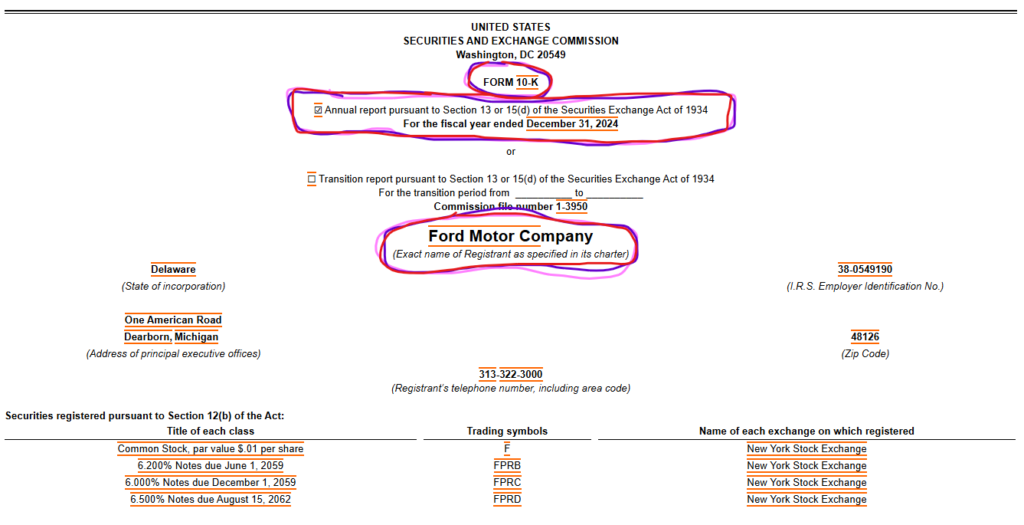

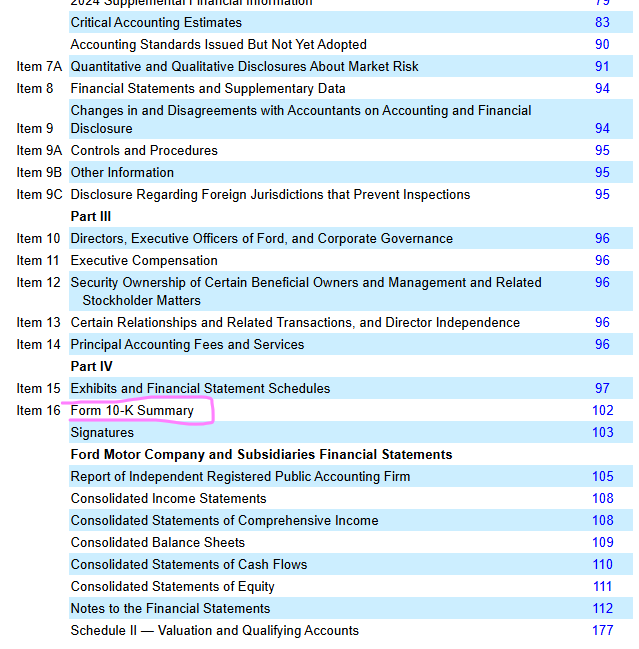

Form 10-K:

For most companies, the SEC required 10-K form has more information inside than the company’s annual report to shareholders. Some companies take their annual audited 10-K form and utilize it to send as their annual report to shareholders.

Companies are not allowed to make materially false or misleading statements within their 10-Ks, nor are they permitted to omit material information.

The Sarbanes-Oxley Act requires a company’s CFO & CEO to certify the accuracy of material inside Form 10-K. The Sarbanes Oxley Act also requires the SEC to review a public company’s financial statement at least once every three years.

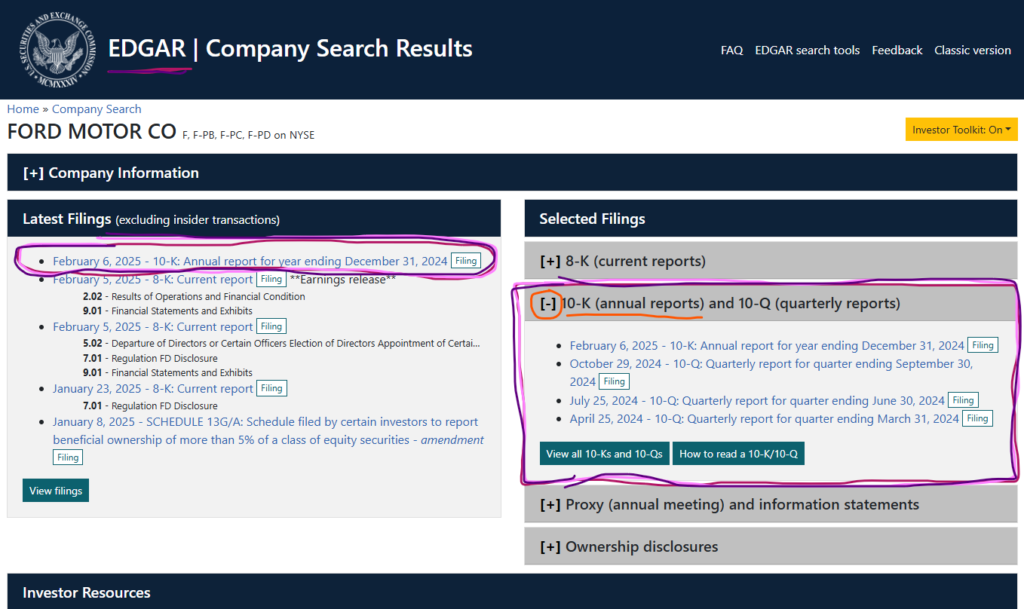

Most 10-Ks are posted on the company’s website. However, all 10-K’s that are filed with the SEC are posted on the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) database.

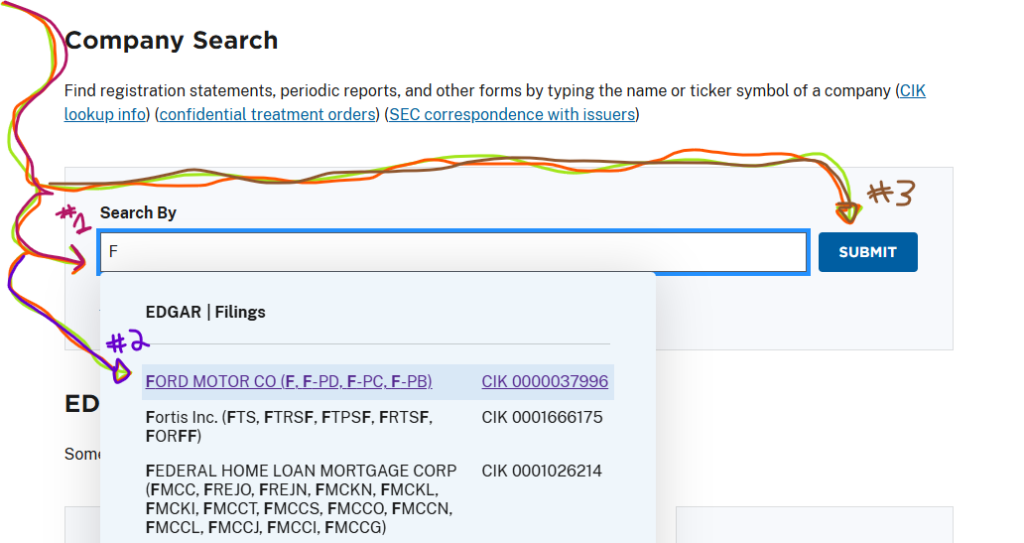

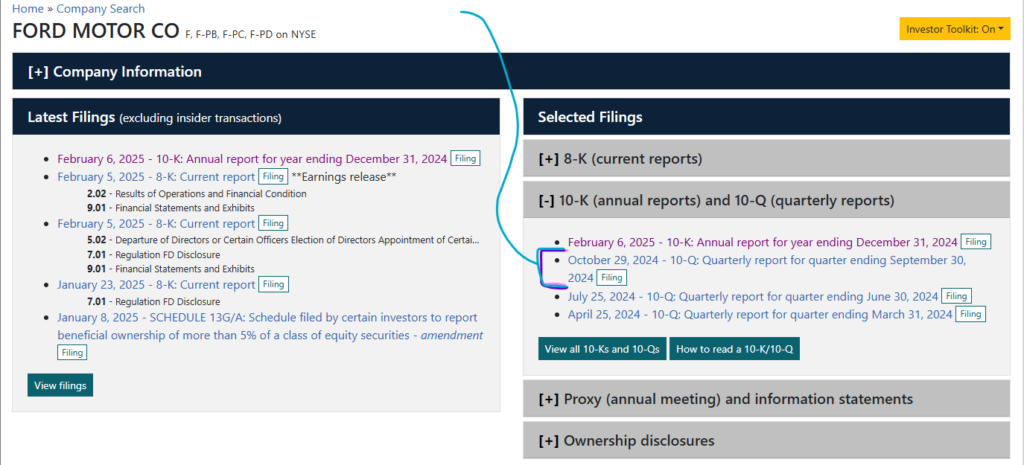

Using EDGAR to Find Ford Motor Co.’s Annual 10-K Filing

Below is an example of how to utilize EDGAR to find Ford Motor Co.’s annual 10-K. Click the image to find EDGAR on the SEC website.

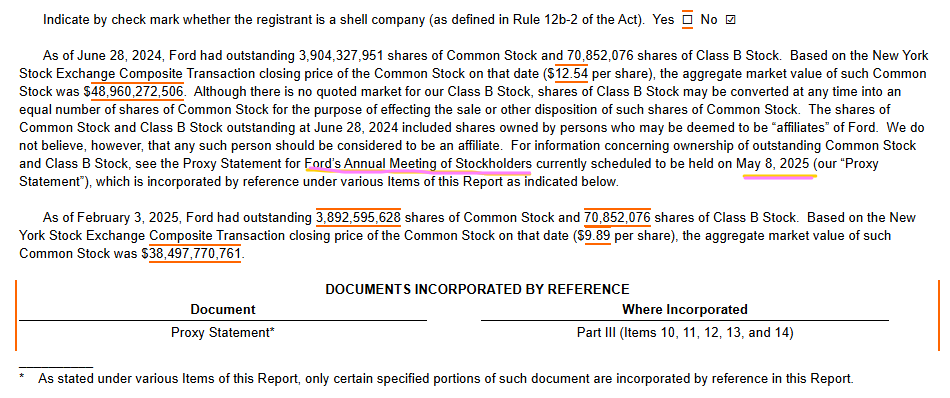

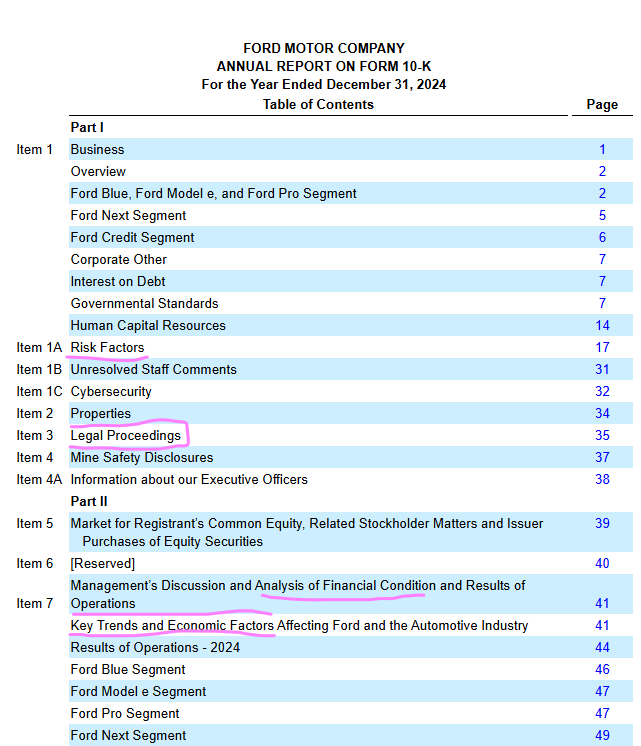

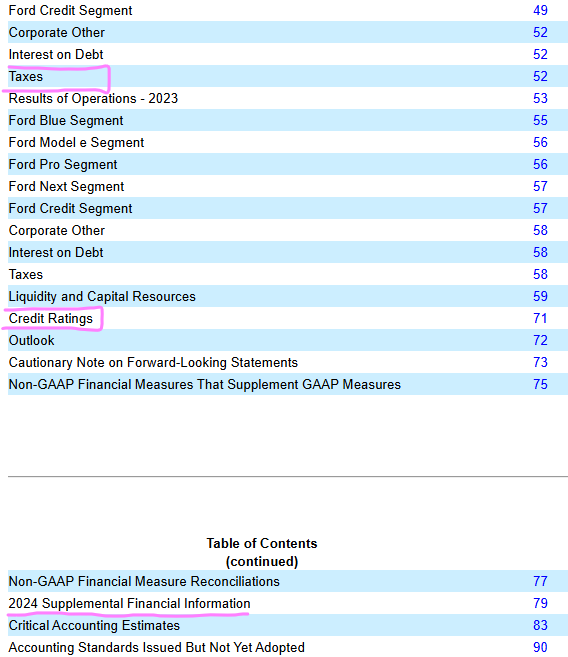

Ford Motor Company’s actual 10-K report for the fiscal year ended in December 31, 2024, is over 170 pages long.

If you scroll down a bit, you will see that Ford’s Annual Meeting of Stockholders is scheduled to be held on May 8, 2025.

Form 10-K provides so much useful information that shareholders often utilize to perform fundamental analysis and make good investment decisions.

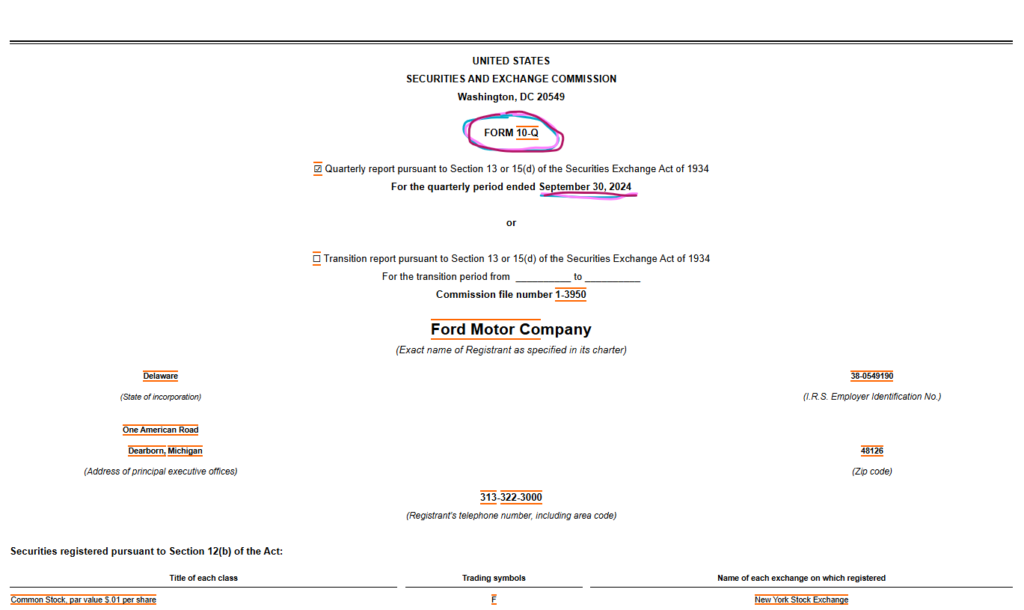

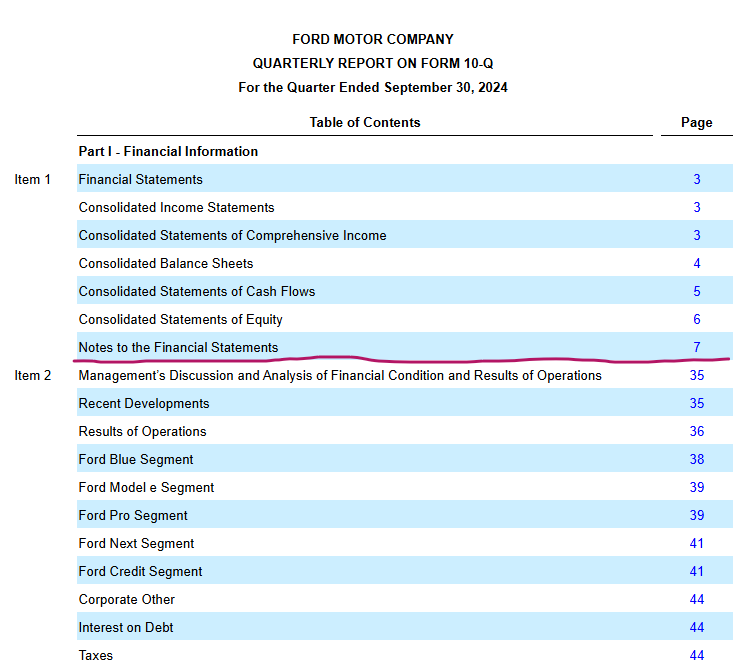

Form 10-Q

Form 10-Q is an unaudited quarterly report that the SEC requires most publicly traded companies to file. This form is usually filed the first three fiscal quarters a year, as the fourth quarter the annual 10-K is filed.

Form 10-Q provides a report on the company’s performance & financial position throughout the year.

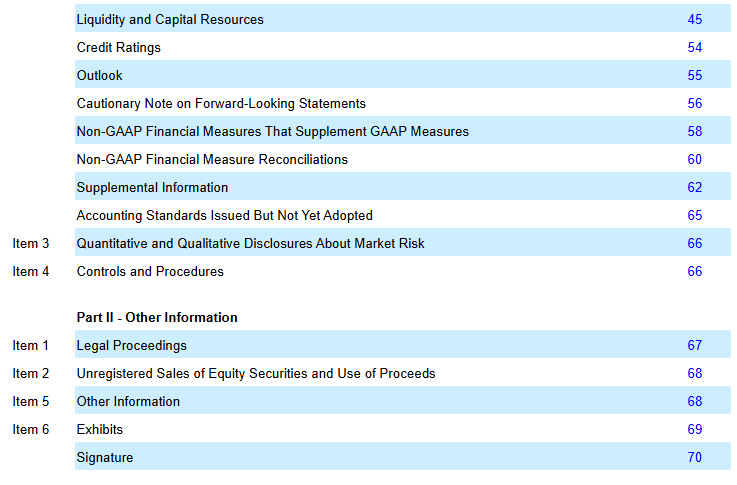

Let’s take a peek at Ford Motor Co.’s Form 10-Q for the third quarter of 2024 (Sept 30, 2024).

As you will see, the topics focused on in the quarterly unaudited Form 10-Q are similar but not as encompassing as the audited annual Form 10-K.

Let’s move on to Form 8-K.

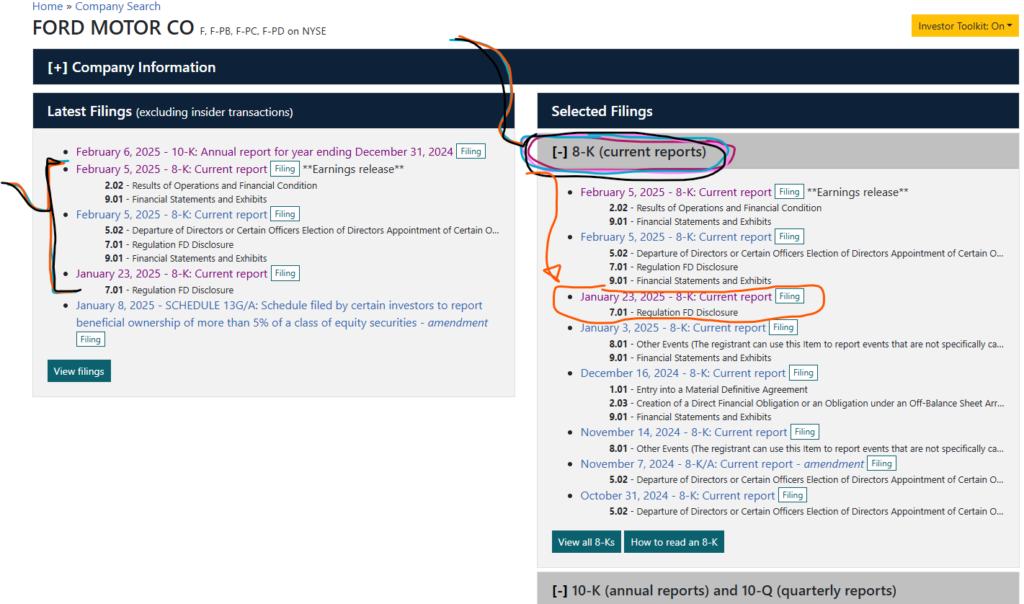

Form 8-K & Ford Motor Co.

The SEC requires that public corporations file Form 8-K when certain material corporate events occur. This form generally must be filed in four business days or less depending on the event.

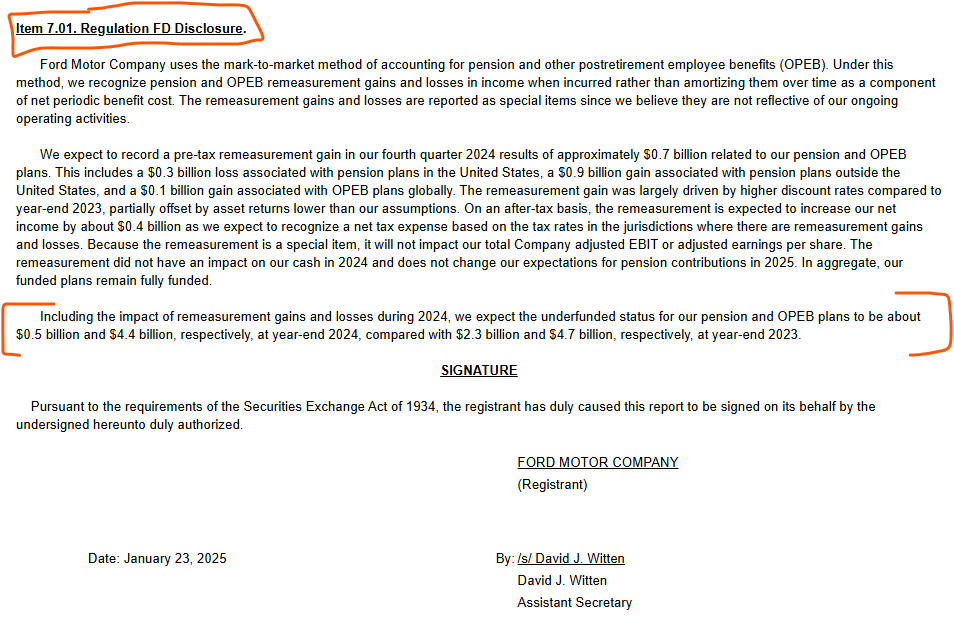

Form 8-K is also utilized to satisfy any obligations under Regulation FD.

Let’s look at a recent 8-K form by Ford Motor Co:

This particular 8-K form is relatively short at just two pages.

Here is what page #2 looks like discussing a Regulation FD Disclosure.

Right #3: Right To Transfer Ownership of Stock

Stockholders can freely sell their shares, as common stock is negotiable. Common stock is negotiable because it can be bought & sold from investor to investor. This is typically accomplished by using an online brokerage firm, though in the past it was more common to call a brokerage firm.

Transfer Agent

The actual process of transfer requires a transfer agent. The transfer agent is often a bank or trust company, but an issuer can be it’s own transfer agent in some cases. Transfer agents must register with the SEC or a bank regulatory agency if a bank.

The transfer agent works for the common stock issuer. The transfer agent records changes of ownership, maintain ownership records, cancel & issue certificates, and distributes dividends.

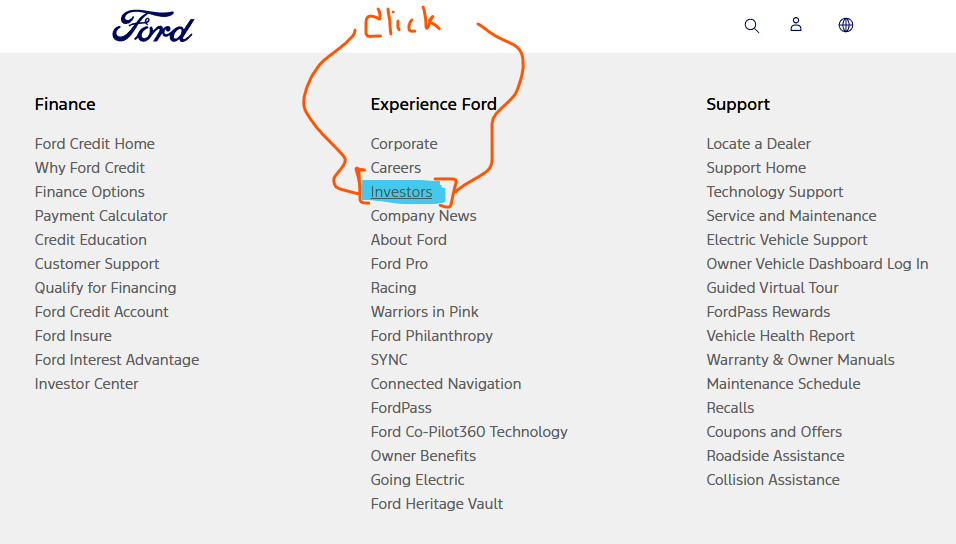

Let’s see if we can find Ford Motor Co.’s Transfer Agent on their Website.

After going to the Ford Website, scroll down until you find “Investors” at near the bottom of the page.

This link brings you to the Investor webpage.

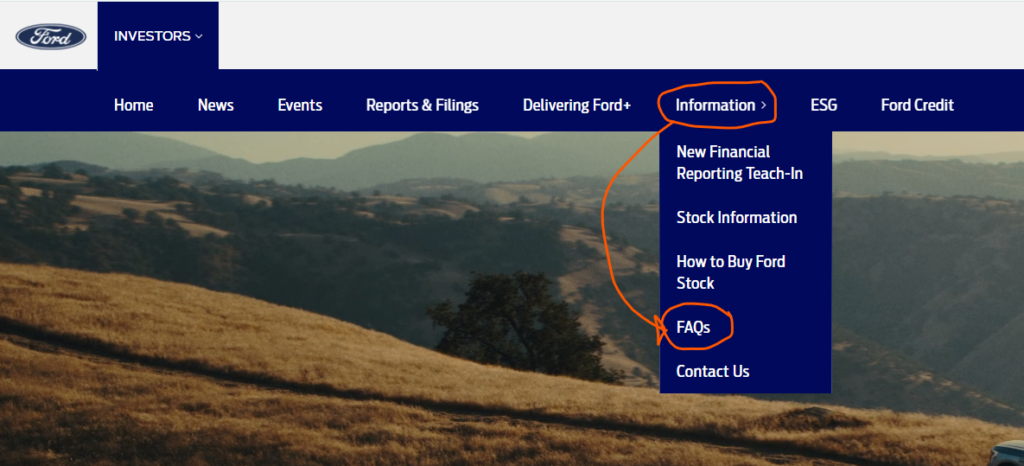

Next, open up the “Information” drop-down list on the menu, and click “FAQ”.

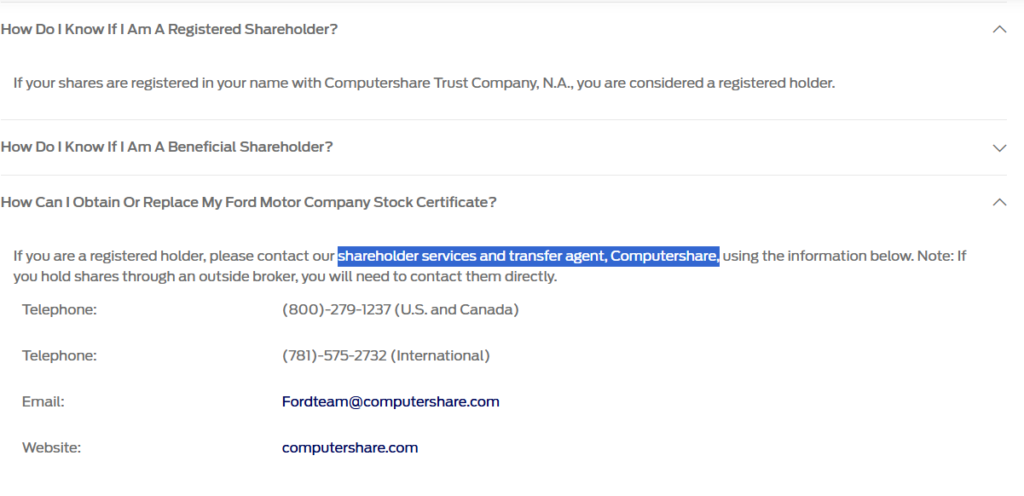

Scroll down till you see “Shareholder Information” and then open the menu item “How Can I Obtain Or Replace My Ford Motor Company Stock Certificate”.

Ford Motor Co.’s transfer agent is listed as: Computershare.

Proverbs 16:8

(NLT): “Better to have little, with godliness, than to be rich and dishonest.”

(ESV): “Better is a little with righteousness than great revenues with injustice.”

(HCSB): “Better a little with righteousness than great income with injustice.”

(LBLA): “Mejor es poco con justicia, que gran ganancia con injusticia.”

Right #4: Right to Receive A Dividend IF Issued

No company is required to pay a dividend. If a dividend is issued, common stock holders do have a right to that dividend.

The company’s Board of Director’s determine whether a dividend will be paid.

The Board of Director’s will make a public announcement if dividends will be paid out.

The date this public announcement occurs is called the declaration date.

This public announcement will often include the record date & payment date, as well as, the size of the dividend.

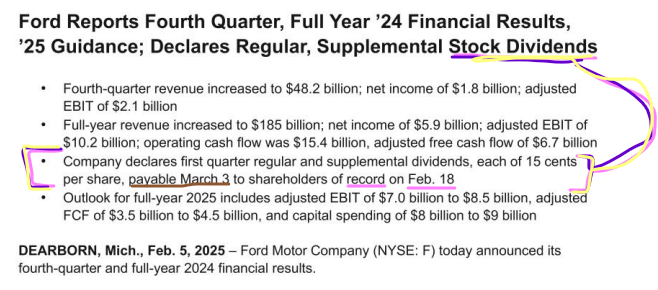

As you can read, Feb 5th 2025 was the declaration date.

March 3rd is considered the payable date. The payable date is when the dividend payment is made to common stockholders of record.

The record date means that the common stock purchase must be settled on or before that date. In Ford’s announcement, the date of record is February 18th.

In many cases, without paying an extra fee, the settlement of common stock typically takes one business day after the day of purchase/trade. Therefore, the stock would need to be purchased one business day before the date of record to settle on the date of record.

Since February 18th is on a Tuesday, the stock would need to be purchased that Monday the 17th, since settlement typically takes an additional day.

It is worth noting that if the stockholder decides to sell their stock on the payable date, since the record of ownership had not changed yet, the seller would still receive a dividend. The buyer would not, since they were not an owner of that stock by the date of record.

Right #5: Right To Assets Upon Liquidation IF Any Is Leftover

If a bankruptcy court forces a publicly traded company to liquidate it’s assets, common stock holders have the right to receive compensation, but typically will not actually receive any compensation.

See my other article to explain why!

Right #6: Right To Sue For Certain Wrongful Actions

Common stockholders have equity (ownership) in the company they purchased the stock from.

As stockholders with equity, they have an interest in making sure the company perform’s their duties legally & correctly. If illegal action is suspected, there are some forms of legal remedies available for common stockholders.

A shareholder derivative suit “is a lawsuit brought by a shareholder or group of shareholders on behalf of the corporation against the corporation’s directors, officers, or other third parties who breach their duties.”

A shareholder direct suit is when “[a] shareholder . . . bring[s] a direct suit against a director or officer if the corporation breached its duty and caused their actual injury.”

Right #7: Right To Capital Appreciation When Share Is Sold

If the company grows, the value of the stock may grow over time. This growth can result in capital gain’s/appreciation if the stock is sold at an increased price from initial purchase.

Capital appreciation is a rise in an investment’s market price; whereas, capital gain occurs when that investment is sold. Capital appreciation is not taxed, until it is sold, and becomes a capital gain. Capital gain IS taxed.

Right #8: Preemptive Right To Maintain Proportionate Ownership Levels

Common stockholders have the preemptive right to maintain proportionate ownership levels. This means common stockholders have the First Right Of Refusal / Right of First Offer to buy additional shares of stock the issuer sells in future offerings proportionate to their existing ownership. The shareholders in this case must have an offer to purchase before the issuer sells to a third party.

The stockholder does not have an obligation to purchase the additional shares, but has the option too.

Proverbs 16:18

(LBLA): “Delante de la destrucción va el orgullo, y delante de la caída, la altivez de espíritu.”

(NIV): “Pride goes before destruction, a haughty spirit before a fall.”

(NLT): “Pride goes before destruction, and haughtiness before a fall.”

Leave a Reply