Proverbs 15:2

(NLT): “The tongue of the wise makes knowledge appealing, but the mouth of a fool belches out foolishness.”

(CSV): “The tongue of the wise makes knowledge attractive, but the mouth of fools blurts out foolishness.”

(ESV): “The tongue of the wise commends knowledge, but the mouths of fools pour out folly.”

Sources:

(1) https://www.td.com/ca/en/investing/direct-investing/articles/common-stock#:~:text=Can%20I%20lose%20all%20my%20money%20investing%20in%20common%20stocks%3F

(2) https://app.achievable.me/study/finra-sie/learn/common-stock-right-of-common-stockholders-rights-to-assets-upon-dissolution-of-the-company

(3) https://www.irs.gov/businesses/small-businesses-self-employed/declaring-bankruptcy

(4) https://www.uscourts.gov/court-programs/bankruptcy/bankruptcy-basics/process-bankruptcy-basics

(5) https://www.floridabar.org/directories/courts/websites-bankruptcy/

(6) https://www.uscourts.gov/forms-rules/current-rules-practice-procedure/federal-rules-bankruptcy-procedure

(7) https://constitution.congress.gov/browse/essay/artI-S8-C4-2-1/ALDE_00013180/

(8) https://constitution.congress.gov/constitution/article-1/#article-1-section-8-clause-4:~:text=of%20a%20Bill.-,Section%208,-The%20Congress%20shall

(9) https://uscode.house.gov/browse/prelim@title11&edition=prelim

(10) https://www.caeb.uscourts.gov/documents/forms/edc/EDC.002-070.pdf

(11) https://www.mtb.uscourts.gov/node/371

(12) https://www.foxbusiness.com/economy/us-corporate-bankruptcy-filing-spiked-march-sp-global

(13) https://www.law.uw.edu/news-events/news/2023/svb-collapse

(14) https://www.armstrongteasdale.com/thought-leadership/silicon-valley-banks-parent-files-for-chapter-11-bankruptcy-what-you-need-to-know/

(15) https://www.investopedia.com/articles/01/120501.asp

(16) https://www.finra.org/investors/insights/what-corporate-bankruptcy-means-shareholders

(17) https://finance.yahoo.com/news/hot-trend-buying-bankrupt-stocks-143710495.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAL7M5EV6pp2poC2Kp-2264sRo64aMo-GIOQd7ZsQZ7lpnY8jgt2_Daq9ID6brioB1Cp2qlLmstBbejLwRm1Q4OwH1wMiwbkVKFrBvSV3WVjP4C0iXOP0HBRQfdxT-bYYnKH9Ynkk4v-BoATlxHutUmUH_qEpeJXRmJ9PyZK8BwKB

(18) https://www.forbes.com/sites/danbigman/2013/10/30/how-general-motors-was-really-saved-the-untold-true-story-of-the-most-important-bankruptcy-in-u-s-history/#:~:text=In%20the%20popular%20version%20of,and%20spinning%20out%20its%20valuable

(19) https://www.uscourts.gov/court-programs/bankruptcy/bankruptcy-basics/chapter-7-bankruptcy-basics

(20) https://www.uscourts.gov/court-programs/bankruptcy/bankruptcy-basics/securities-investor-protection-act-sipa

(21) https://www.flnb.uscourts.gov/chapter-7-liquidation#:~:text=Entities%20(non%2Dindividual%20debtors)%20such%20as%20corporations%20or%20other%20business%20debtors%20may%20not%20file%20bankruptcy%20without%20legal%20counsel

(22) https://www.justice.gov/ust/list-credit-counseling-agencies-approved-pursuant-11-usc-111

(23) https://www.investopedia.com/articles/stocks/07/100_equities.asp

What Is Bankruptcy?

Bankruptcy is a legal proceeding & process that enables “debtors a financial ‘fresh start’ from burdensome debts.” In some Chapter 7 cases, this fresh start may only apply to individuals, not partnerships or corporations. Stockbroker liquidation will often fall under the Securities Investor Protection Act of 1970, rather than the Bankruptcy Code.

There are several types of bankruptcy available in the United States: Chapter 7, Chapter 11, Chapter 12. and Chapter 13. This article will focus on Chapter 7 & Chater 11 bankruptcies for companies, not individuals or partnerships. Corporations will require legal counsel to file, and company owners can not file on their own.

However, while debtors (the corporation filing bankruptcy) may be given a ‘fresh start’, investors may be at risk of getting their investments back.

Getting your investment returns back will depend upon “the type of bankruptcy and the type of investment you hold.

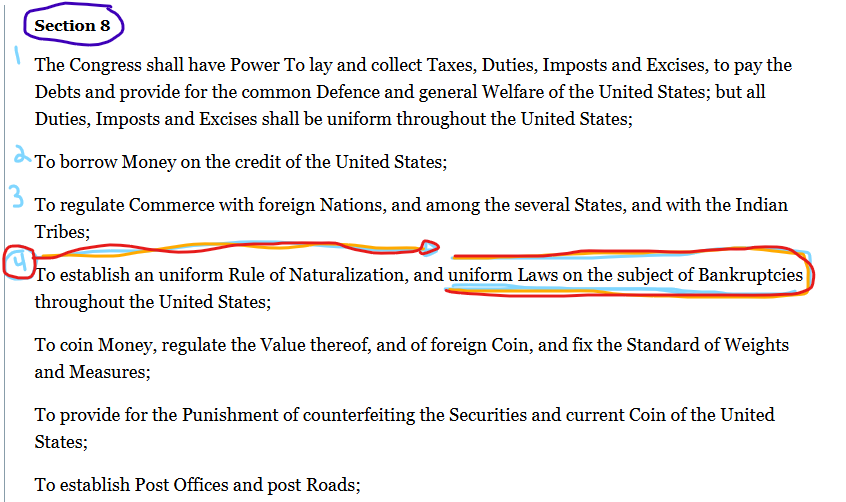

U.S. Constitution: Article 1, Section 8

Bankruptcy stems from Article 1, Section 8, Clause 4 of the United States Constitution which allows Congress to enact “uniform Laws on the subject of Bankruptcies throughout the United States.”

Title 11 U.S.C.

Using their Constitutional authority, Congress enacted the “Bankruptcy Code” in 1978, which is now codified as Title 11 of the United States Code (U.S.C.).

Title 11 of the U.S.C. is the uniform federal law that governs all bankruptcy cases in the United States.

Federal Rules of Bankruptcy Procedure

The Federal Rules of Bankruptcy Procedure guide the procedure of our bankruptcy processes in America.

Where Are the Courts?

Each judicial district in America has a bankruptcy court.

There are 90 bankruptcy districts in the country, which means some states have more than one bankruptcy court.

Florida has three U.S. Bankruptcy court districts split into eleven different divisions.

California has four U.S. Bankruptcy court districts split into thirteen different divisions.

In contrast to Florida & California, the state of Montana has one U.S. Bankruptcy Court division split into four divisions.

Corporate Bankruptcy

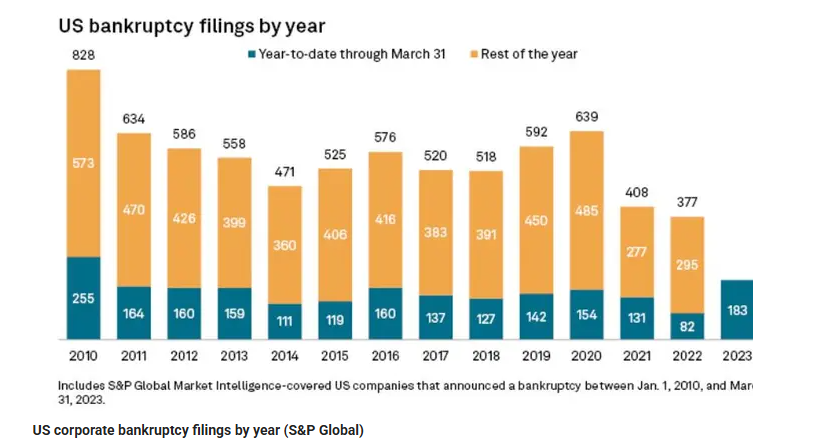

From January of 2023 to March of 2023, 183 major companies formally announced their bankruptcies, with the parent company of Silicon Valley Bank (SVB Financial Group) among them.

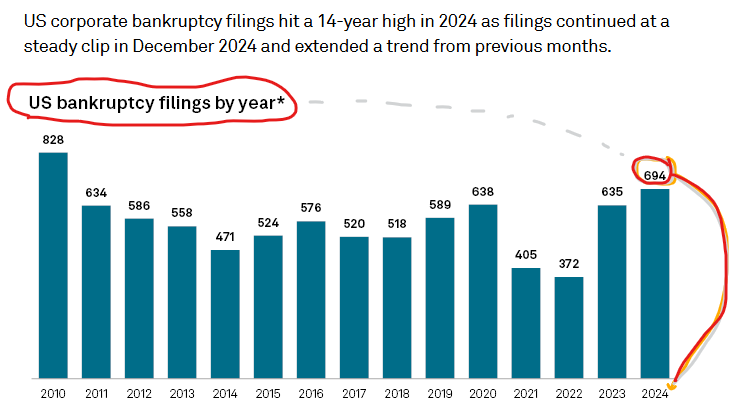

This number would grow to 635 by the end of 2023.

694 corporate bankruptcies were filed by the end of 2024, surpassing 2023.

Chapter 7 or Chapter 11: For A Corporation

Typically, companies are only allowed to file Chapter 7 or Chapter 11 bankruptcy. Chapter 7 will liquidate the company’s assets & seize operating; whereas, Chapter 11 allows the company to operate under a reorganization plan. If the Chapter 11 reorganization fails, a Section 363 sale-with court approval-can occur.

Many companies choose Chapter 11 bankruptcy, despite the high expense, because they can participate in the bankruptcy process while running business operations. Chapter 7 bankruptcy forces the company to turn over assets to a court-appointed trustee for liquidation without the participation mechanisms that Chapter 11 bankruptcy allows.

The Chapter 11 bankruptcy process requires the formation of a government-appointed committee to represent creditor & stockholder interests. This committee works alongside the company to form a plan to get out of the debt & reorganize the company to become more profitable. Occasionally, shareholders are given a vote on the plan; however, the bankruptcy court can still override the shareholder decision.

Proverbs 15:14

(ESV): “The heart of him who has understanding seeks knowledge, but the mouth of fools feeds on folly.”

(HSCB): “A discerning mind seeks knowledge, but the mouth of fools feeds on foolishness.”

(KJV): “The heart of him that hath understanding seeketh knowledge: But the mouth of fools feedeth on foolishness.”

How Does Bankruptcy Impact Investors?

The securities of a company may continue during most bankruptcy proceedings, there is no federal law stating bankrupt companies can trade on their stocks. However, these securities will likely be trading at a reduced price (with the letter Q appended to their stock symbols).

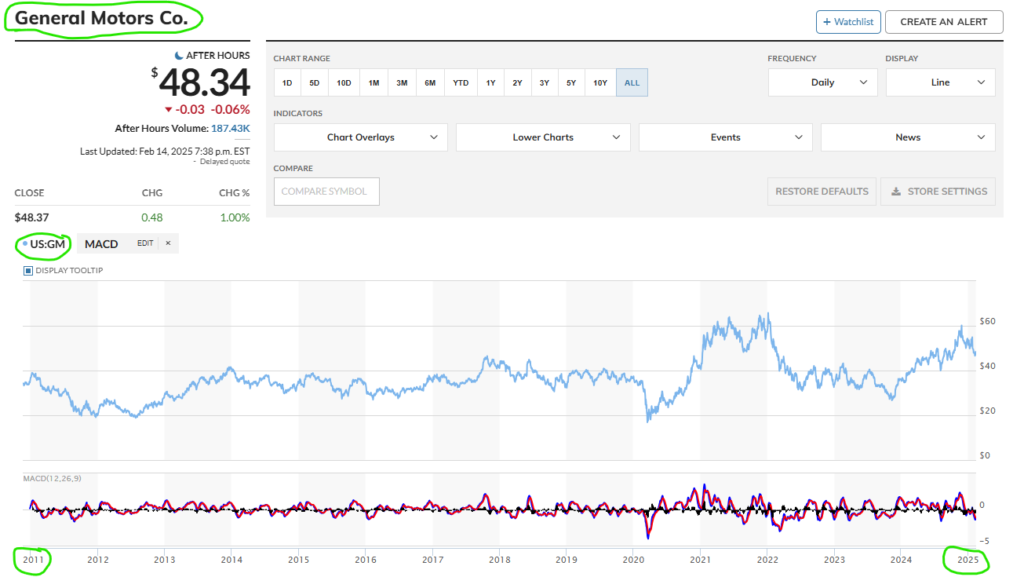

After filing Chapter 11 bankruptcy in 2009, General Motors (NYSE: GM) became GMGMQ & MTLQQ.

This reduced price may fail to meet the price requirements to be listed on an exchange. However, over-the-counter trading may still be an option. Chapter 11 bankrupt companies may be traded on the OTC Bulletin Board (OTCBB) or Pink Sheets. These stocks traded on the OTCBB or Pink Sheets may not require typical financial reporting required of publicly-traded companies on exchanges.

Bond rating companies will likely reduce the value of the bond. Common stock will likely reduce in value.

In some cases, if a company is required to liquidate its assets, common stockholders may not get back any of their investments. In 2009-2010, shareholders of only four publicly traded companies got back some return out of the 41 publicly-traded companies that went Chapter 11 bankrupt that year.

During Chapter 11 proceedings, bondholders will not receive interest & principal payments and stockholders will not receive dividends. After reorganization, old stock may have to be exchanged for new stock with the new reorganization company. FINRA & SEC rules do not currently require this exchange from old to new stock.

In 2009, General Motors filed Chapter 11 Bankruptcy, and the resulting reorganization plan partially devised by Jay Alix resulted in a successful turnaround with GM recovering and existing as of 2025.

In fact . . .

However, recovery from Chapter 11 Bankruptcy reorganization is rare; General Motors is an exception to the norm. In these exceptional cases, buying or holding on to stock during the reorganization process could benefit a portfolio. However, companies like Fidelity do not recommend individual investors partake in this high-risk strategy.

So, what about Chapter 7 Bankruptcy? What exactly is liquidation??

What Is Liquidation?

When a company goes bankrupt under Chapter 7 of the U.S. Bankruptcy Code, a government-appointed trustee will liquidate the company’s nonexempt assets under the provisions of the Bankruptcy Code. In many cases, Chapter 7 bankruptcy will occur within 180 days of meeting with an approved credit counseling agency unless the trustee or bankruptcy administrator “has determined that there are insufficient approved agencies to provide the required counseling. If a debt management plan is developed during required credit counseling, it must be filed with the court.”

Most likely the company will go out of business while the trustee performs liquidation.

Liquidation is “the sale of a debtor’s nonexempt property and the distribution of the proceeds to creditors.

The idea behind a liquidation is to ensure that debts are paid off. There is typically an order of liquidation that will be followed by the trustee or bankruptcy administrator.

Common Order Of Liquidation:

Here is a common order of liquidation:

(1) Unpaid wages

(2) Unpaid taxes

(3) Secured creditors

(4) Unsecured creditors (senior)

(5) Junior Unsecured creditors

(6) Preferred stockholders

(7) Common Stockholders

Notice how common stockholders are the last to get paid?! Basing an entire investment portfolio in common stock may be an unwise financial decision. Beyond the risk of bankruptcy & default, human psychology has an impact in how difficult it is for investors to stay-the-course in a difficult strategy during extended periods of market drought. Generally, diversity in a variety of asset classes is a better strategy than 100% investment in one form of security.

It is worth noting that #3 on the list-secured creditors, have first rights to any collateral backing their loan. However, if the collateral does not completely cover the secured loan, the remaining balance might be covered following the common order of liquidation.

Here is an example of a secured loan pay-off:

A company has $8000 in assets not utilized for collateral & $1500 in assets utilized for collateral for a secured loan.

A secured creditor is owed $2,000.

However, the company also owes $5000 in wages & $3500 in outstanding taxes.

The collateral, which backs the secured loan, is liquidated for $1500.

The secured creditor has first rights to this collateral bringing their owed balance from $2000 – $1500 to a remaining $500.

The company still has $8000 left in assets to liquidate. However, the company has to first pay outstanding wages.

So, $8000 – $5000 = $3000 remaining, after wages are paid. Next, the company has to pay outstanding taxes before secured creditors. $3000 (remaining balance from liquidation) – $3500 (outstanding taxes) = -$500 owed to taxes.

Therefore, it is unlikely in this scenario that the secured creditor will get the remaining $500 dollars back, since $500 is still owed to outstanding taxes.

Perhaps more important to this lesson, if the secured creditors are not being paid in full, it is extremely unlikely that common stockholders-which are last don’t the list-will receive anything at all.

Proverbs 15:28

(ESV): “The heart of the righteous ponders how to answer, but the mouth of the wicked pours out evil things.”

(NIV): “The heart of the righteous weighs its answers, but the mouth of the wicked gushes evil.”

(LBLA): “El corazón del justo medita cómo responder, mas la boca de los impíos habla lo malo.”

Leave a Reply