Proverbs 19:2

(NIV): “Desire without knowledge is not good–how much more will hasty feet miss the way!”

(NKJV): “Also it is not good for a soul to be without knowledge, And he sins who hastens with his feet.”

(LBLA): “Tampoco es bueno para una persona carecer de conocimiento,

y el que se apresura con los pies peca”

Sources:

(1) Achievable SIE Textbook

(2) https://www.investopedia.com/terms/d/derivative.asp

(3) https://www.cmegroup.com/company/visit/

(4) https://corporatefinanceinstitute.com/resources/derivatives/derivatives/

(5) https://listingcenter.nasdaq.com/rulebook/ise/rules/ISE%20Options%204

(6) https://www.fidelity.com/learning-center/investment-products/options/buying-option-calls-video.

(7) https://www.investopedia.com/terms/e/economic_derivatives.asp

(8) https://www.eia.gov/finance/markets/crudeoil/financial_markets.php

(9) SIE Exam 2025/2026 For Dummies, 4th Edition. Steven M. Rice

(10) https://www.businessinsider.com/personal-finance/investing/derivative

(11) https://www.cftc.gov/IndustryOversight/IndustryFilings/TradingOrganizations?page=1

(12) https://corporatefinanceinstitute.com/resources/commercial-lending/financial-leverage/

(13) https://www.schwab.com/learn/story/understanding-margin-and-leverage-trading

(14) https://www.optionseducation.org/

(15) https://olui2.fs.ml.com/publish/content/application/pdf/gwmol/standardoptionagreement.pdf

(16) https://www.theocc.com/Company-Information/Documents-and-Archives/Options-Disclosure-Document

(17) https://www.cmegroup.com/education/courses/introduction-to-options/understanding-the-difference-european-vs-american-style-options.html

(18) https://corporatefinanceinstitute.com/resources/derivatives/swap/

(19) https://www.cftc.gov/MarketReports/SwapsReports/DataDictionary/index.htm#:~:text=FX%20Products,trading%20of%20currency

(20) https://economictimes.indiatimes.com/definition/swap?from=mdr

(21) https://corporatefinanceinstitute.com/resources/derivatives/futures-forwards/

(22)

Defining: “Derivative”

A derivative, in the financial world, refers “to a type of financial contract whose value is dependent on an underlying asset, a group of assets, or a benchmark. Derivatives are agreements set between two or more parties that can be traded on an exchange or over the counter (OTC).”

Hedgers, arbitrageurs, speculators & margin traders are common users of derivatives.

Originally, derivatives were utilized to balance exchange rates for foreign currencies & globally traded goods. The derivatives could potentially be utilized to minimize/hedge the exchange rate risk inherent in the purchase/sale of a foreign nation’s securities.

Most derivatives share similar components: a contract expiration date, contract size, pricing, margin, premiums, and parties involved.

Some derivatives trade over-the-counter (directly between two institutions), whereas, others trade on exchanges like the Chicago Mercantile Exchange.

The Chicago Mercantile Exchange (CME) is a large global derivative exchange that merged with CME and became a subsidiary of CME Group Inc.

The CME Group also consists of the New York Mercantile Exchange (NYME).

The Underlying Assets Of A Derivative

Derivatives depend on underlying assets.

Fluctuations in the price of the underlying asset impact the price of a derivative.

The underlying assets take various forms: stocks, bonds, commodities, currencies, market indexes, and economic indicators.

Economic indicators, commonly utilized for underlying assets include: gross domestic product (GDP), purchasing managers index, and the national unemployment rate.

What is Leveraging?

Many derivatives are leveraged. The greater risk involved with most leveraged derivative-based contracts makes trading derivatives a form of advanced investing.

Leveraging involves using borrowed capital (money) to purchase assets/securities with an expectation that the pay-off (profits) will be greater than the cost of leveraging. Many companies are heavily leveraged, primarly relying on bonds, like utility companies.

Most providers of leverage will limit it’s risk by limiting the extent of leverage it is willing to provide. In some cases leverage, will be backed with a collateral, otherwise, the company/investor’s creditworthiness will factor in.

Proverbs 19:8

(NIV): “The one who gets wisdom loves life; the one who cherishes understanding will soon prosper.”

(NKJV): “He who gets wisdom loves his own soul; He who keeps understanding will find good.”

(LBLA): “El que adquiere cordura ama su alma;

el que guarda la prudencia hallará el bien.”

Types of Derivatives:

Derivatives can include: options, swaps, futures, and forwards.

Futures, forwards, and swaps, lock/bind the parties into any agreed-upon, court-legal, terms over the contract’s lifespan.

Option contracts are a bit different as we will see . . .

Options:

Options are a financial derivative contract.

Options contracts give the purchaser/buyer the right, to trade the underlying asset at the strike (specific) price during a set time period.

Options can be utilized to protect a portfolio against a market downturn by purchasing options “on an index that tracks the type of stocks in your portfolio.” However, there are other strategies and reason to utilize options.

The brokerage firm utilized to trade may limit availability to specific kinds of option trading strategies depending on the investor profile.

The brokerage firm may also require filling out an options agreement form & the document Characteristics and Risks of Standardized Options (Options Disclosure Document – ODD).

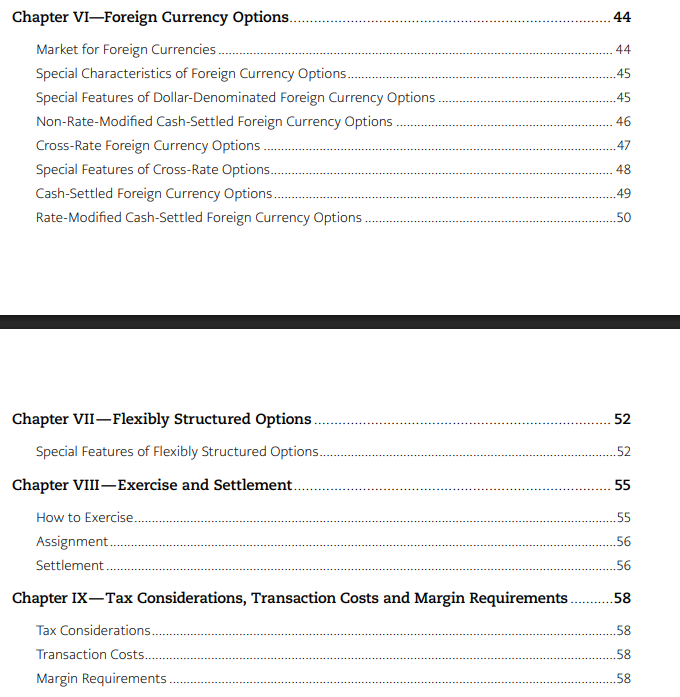

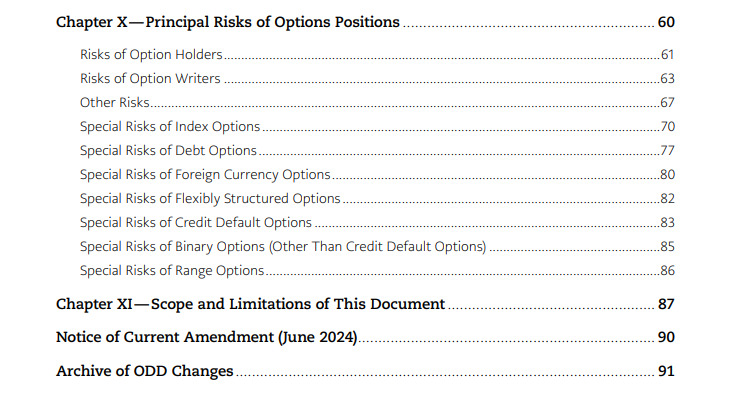

The June 2024 version of the Characteristics and Risks of Standardized Options document is 96 pages long. Here are some of the topics within:

Buyer vs. Seller & Their Obligations

What makes an options contract unique is that the purchaser/buyer is not required/obligated to exercise the contract.

However, the seller IS obligated to fulfill the contract, if the buyer/purchaser wants to exercise the right.

However, the buyer must exercise their right by a defined expiration date.

Call & Put Options

An option that gives the right to buy is a call option.

An option that gives the right to sell is a put option.

Calls & puts do NOT involve the other, a contract that involves the right to buy is a call. The option that gives the right to sell is a put.

Length of Contract

Many options contracts expire within nine months from their issuance.

Longer options contracts do exist.

Speculation vs. Ownership

What makes derivatives unique, is that they can be based upon speculation. Therefore, the derivative contract does not require actually owning the underlying asset; but instead, speculating on a specific price movement of that underlying asset.

Different Countries: Different Rules

American option rules may differ from European option rules.

American options can be bought in Europe & European options can be bought in America.

European options tend to be exercised only at expiration. American options typically are exercised any time prior to expiration. American style options tend to be “quarterly options on the S&P500 futures contracts, SOFR options, and treasury options.”

Swaps:

Swaps are a derivative contract often utilized to hedge risk & uncertainty. However, swaps also enable investors to access new markets, like utilizing a currency swap with a Japanese company if that Japanese company is able to borrow at a lower rate.

Swaps are not traded on exchanges; instead, swaps are traded over-the-counter (institution to institution or investor to investor).

Common types of swaps include: interest rate swaps, currency swaps (FX), commodity swaps, and credit default swaps. Currency swaps & interest rate swaps are the two most common kinds of swaps.

Futures:

Futures are an agreement/contract “between two parties for the purchase and delivery of an asset at an agreed-upon price at a future date.” Unlike options, both parties are obligated to their respective terms in a futures contract.

Future contracts, like all derivative assets, derive their values from changes in the underlying assets.

Futures contracts are settled daily, which means they can be bought/sold often.

Futures, unlike options & swaps, are traded on public exchanges. There is a lower risk involved in the buyer/seller not fulfilling their obligations, due to the regulation & oversight provided.

Forwards:

Forwards (forward contracts) hedge against risks & allow for speculation. Like all derivatives, forwards derive their values from changes to the underlying assets.

Both the seller & the buyer of forward contracts are obligated to fulfill their contracts at maturity/expiration date. The forward contract will have a specific price known as the forward price.

Forwards are typically not traded on public exchanges; there is also a reduced amount of regulation & oversight (compared to Futures & Options).

Example of Forwards:

Mark owns a local cafe where he sells breakfoods, various teas, and grinds fresh coffee beans. Mark typically purchases these coffee beans from his supplier, MegaBean Coffee, for $3.40 a lb.

Mark’s supplier, MegaBean Coffee lives in a particularly politically instable region of South America. Worried that MegaBean Coffee may have to increase their prices in the future due to effects from political instability such as extortion, Mark wants to negotiate a forwards contract with MegaBean Coffee.

The forwards contract is for: $3.45 a lb, at 500lbs of coffee, and will mature in 8 months.

MegaBean Coffee, does not think any volatile changes will occur that will cause them to raise their prices. In fact, MegaBean Coffee is more worried that Mark’s Cafe will go out of business, as small coffee shops tend to do. Therefore, MegaBean Coffee accepts Mark’s futures contract.

Here are three scenarios that could result from this forwards contract:

Scenario A:

Political instability worsens in the region of South America where MegaBean Coffee’s factory & farm are located. MegaBean Coffee finds themselves forced to shut down, unless they give the new regime extra money every month as a “tax”. MegaBean Coffee has to raise the cost of their coffee to $3.75 a lb to maintain the same profit margins as before. However, due to their futures contract, they will not be able to raise their price with Mark’s Cafe.

In this scenario, Mark’s Cafe was able to avoid the price increase, and purchase 500 lbs of coffee at the futures contract price of $3.45lb a pound.

However, MegaBean Coffee is allowed to raise their prices to other suppliers who they don’t have a futures contract with.

The outcome:

Mark’s Cafe original purchase price of coffee was at $3.40 per lb. Purchasing 500 lbs of coffee would cost: $1,700.

However, since the prices were raised (due to political instability) to $3.75 a lb, then purchasing $500 would have cost Mark: $1,875.

Purchasing 500lbs of coffee at $3.45 per lb cost Mark: $1,725.

So, while the cost of coffee was a bit more expensive ($25) than before the futures contract was made, Mark ended up saving: $150 dollars. For a small business, a $150 dollars can amount to alot.[$1,875-$1,725 = $150].

Scenario B:

Political instability worsens in the region of South America where MegaBean Coffee’s factory & farm are located. MegaBean Coffee finds themselves overrun & overtaken by the new regime. However, the regime leader’s son has a savy business mind.

He analyzes the pricepoint of competitor’s in the region, and realizes that MegaBean Coffee’s original pricepoint was too high. He reduces the pricepoint to $2.75 a lb for all purchases over 300 lbs and keeps the pricepoint the same for anything less than 300 lbs.

Mark’s Cafe wishes to take advantage of this new, reduced price point. However, Mark will have to honor the futures contract he made, and purchase 500lbs of coffee at $3.45lb a pound. However, after, Mark honors his contract with MegaBean Coffee he will likely be able to purchase at the lower price.

Outcome:

Mark must purchase 500lbs of coffee at $3.45 per lb which will cost him: $1,725.

If Mark never entered into the futures contract with MegaBean Coffee, he would be able to purchase 500lbs of coffee at $2.75 a lb which would have cost him: $1,375.

Mark lost the ability to save $350 dollars by having to honor the future’s contract and purchase at the agreed upon contractual price of $3.45 per lb.

Scenario C:

The region around MegaBean Coffee never experienced any political instability at all. In fact, the region appeared to have stabilized. MegaBean Coffee decided to keep it’s original price point at $3.40 per lb.

Mark, owner of Mark’s Cafe, decides not to honor his agreement. Therefore, Mark does not purchase 500lbs of coffee at the contractual price of $3.45 a lb.

In fact, Mark switches suppliers to SmallBean Coffee, which sits on the western shore of Africa. SmallBean Coffee sells their beans for $3.15 a lb.

Recall: Both parties in a futures contract are legally obligated to fullfill the terms of the contract. Mark has to fulfill the terms or he risks putting his business into a risky, costly, and time consuming lawsuit. Other investors will hesitate to do business with Mark & Mark’s company in the future.

Outcome:

If Mark avoids the purchase of coffee from SmallBean Coffe and instead purchases 500lbs of coffee from MegaBean Coffee at $3.45 per lb, which costs Mark: $1,725. Mark will only lose $25 dollars, as the original price point of $3.40 will cost Mark: $1,700 [$1,725 – $1,700 = $25].

However, if Mark refuses to honor his contract with MegaBean Coffee, and instead purchases from SmallBean Coffee, Mark will initially spend $1,575 (500lbs x $3.15). This will initially save Mark $150, since $1,725 – $1,575 equals $150 dollars. BUT, MegaBean Coffee may ask the legal system to back the forwards contract, which will cost Mark the value of the coffee & associated legal costs.

This outcome is NOT a wise one for Mark.

Proverbs 19:17

(KJV): “He that hath pity upon the poor lendeth unto the LORD; and that which he hath given will he pay him again.”

(NKJV): “He who has pity on the poor lends to the LORD, And He will pay back what he has given.”

(LBLA): “El que se apiada del pobre presta al Señor,

y Él lo recompensará por su buena obra.”

Leave a Reply