(WEB): “My son, don’t forget my teaching; But let your heart keep my commandments: For length of days, and years of life, And peace, will they add to you.”

(KJV): “My son, forget not my law; but let thine heart keep my commandments: For length of days, and long life, and peace, shall they add to thee.”

(BLA): “Hijo mío, no te olvides de mi enseñanza , y tu corazón guarde mis mandamientos, porque largura de días y años de vida y paz te añadirán.”

Sources & Inspirations:

(2) Mometrix Test Preparation – Series 7 (4th Edition)

(3) The Holy Bible

(6) Investor.gov: “The Laws That Govern the Securities Industry”

(7) SEC: “About”

(8)SEC: “The Over-The-Counter Market And The Maloney Act” – Speech

(9) FINRA: “FINRA Board of Governors”

(10) Interview with Chief Legal Officer – Robert Colby:

“AN INTERVIEW WITH ROBERT COLBY, CHIEF LEGAL OFFICER OF FINRA.” The RMA Journal, vol. 101, no. 8, May 2019, pp. 64+. Gale Business: Insights, link.gale.com/apps/doc/A592238798/GBIB?u=vic_liberty&sid=summon&xid=9b301f11. Accessed 28 Mar. 2025.

(11) Charles Schwab: “Leveraged and Inverse ETPs: Going, Going, Gone?”

(12) “FINRA arbitrators deny Stifel’s raiding claim, order firm to pay $7 million in legal fees”

(13) https://brokercheck.finra.org/

(14) https://www.finra.org/registration-exams-ce/classic-crd

(15) https://adviserinfo.sec.gov/

(16) FINRA: TRACE

(17) https://www.finra.org/investors/need-help/helpline-seniors

(18) NASAA : The North American Securities Administrators Association

(19) NASD History

(20) FINRA + NASD + NYSE Court Document / News Release

(21) SEC Historical Society: “The Institution of Experience: Self-Regulatory Organizations in the Securities Industry, 1792-2010”

FINRA: Financial Industry Regulatory Authority

FINRA stands for the Financial Industry Regulatory Authority.

In July of 2007, FINRA replaced the National Association of Securities Dealers (NASD).1

FINRA is a self-regulatory organization (SRO) under the oversight of the Securities & Exchange Commission (SEC). As an SRO, FINRA is not governmental but is registered with the SEC.

FINRA is both a private & non-profit membership organization granted power through federal law. As a membership organization, FINRA is funded through member fees. FINRA is not funded through U.S. taxpayers.

The Mission Of FINRA

FINRA’s mission is “to protect investors and safeguard the integrity of our vibrant capital markets to ensure that everyone can invest with confidence.”2

FINRA carries out this mission in numerous ways:3

- writing rules to govern the activities of member firms & the firm’s representatives.

- enforcing those rules & ensuring compliance with both federal law & FINRA regulations.

- monitoring daily market events for misconduct.

- Administering licensure exams.

- Addressing emerging risks before they harm investors & markets.

- operating dispute resolution mechanisms for “investors, member firms and their representatives to provide a fair and efficient venue to handle securities-related disputes”.

Using their dispute resolution forum, FINRA arbitrators recently ruled on a corporate raiding & breach of contract claim.4

FINRA oversees 3,200+ firms & 620,000+ registered representatives.5 Using these firms & representatives, FINRA creates compliance resources like templates & checklists to help these firms develop policies & procedures that protect investors.

FINRA has services like BrokerCheck, the Central Registration Depository, TRACE, and the Securities Helpline for Seniors.

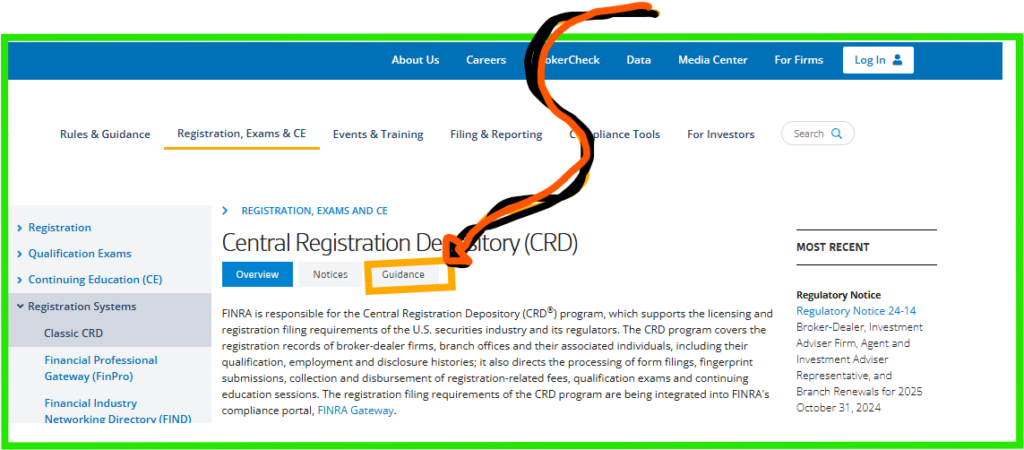

The Central Registration Depository (CRD)

The Central Registration Depository (CRD) program keeps a record of “broker-dealer firms, branch offices and their associated individuals, including their qualification, employment and disclosure histories; it also directs the processing of form filings, fingerprint submissions, collection and disbursement of registration-related fees, qualification exams and continuing education sessions.”6

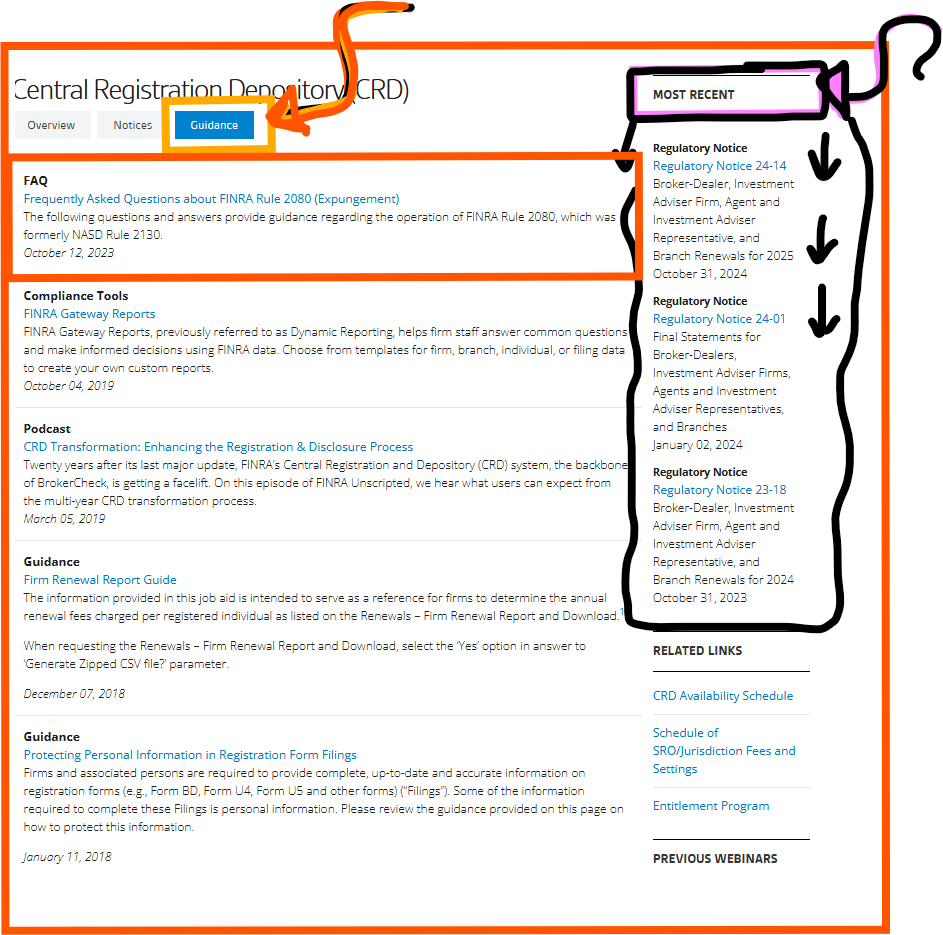

Once on the CRD page, navigate to the Guidance sub-heading.

The Guidance sub-heading, has both an FAQ section & organization by Most Recent. These sub-sub sections might help you understand important compliance tools, rulings, and requirements.

Aspects of the CRD are merging into FINRA Gateway in separate stages. FINRA Gateway will eventually become the primary compliance portal.

BrokerCheck

FINRA’s BrokerCheck lets you check if an individual or firm is registered to sell securities and/or offer investment advice. In addition to BrokerCheck, the SEC also sponsors Investment Adviser Public Disclosure (IAPD).7

BrokerCheck lets you see a “broker’s employment history, regulatory actions, and investment-related licensing information, arbitrations and complaints.”8 However, BrokerCheck does not keep information on civil litigation unrelated to investments. BrokerCheck does record some criminal matters like: known felonies & investment-related misdemeanors.

Assistance: If an individual seeks assistance using BrokerCheck, they can contact the BrokerCheck Help Line at (800) 289-9999. An email address is provided here: BrokerCheck@finra.org.

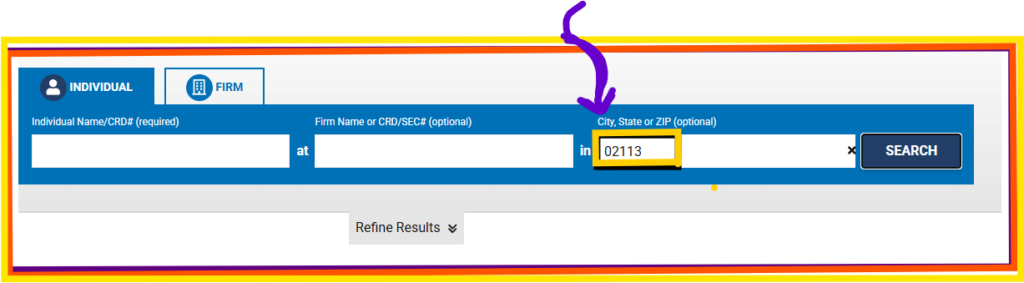

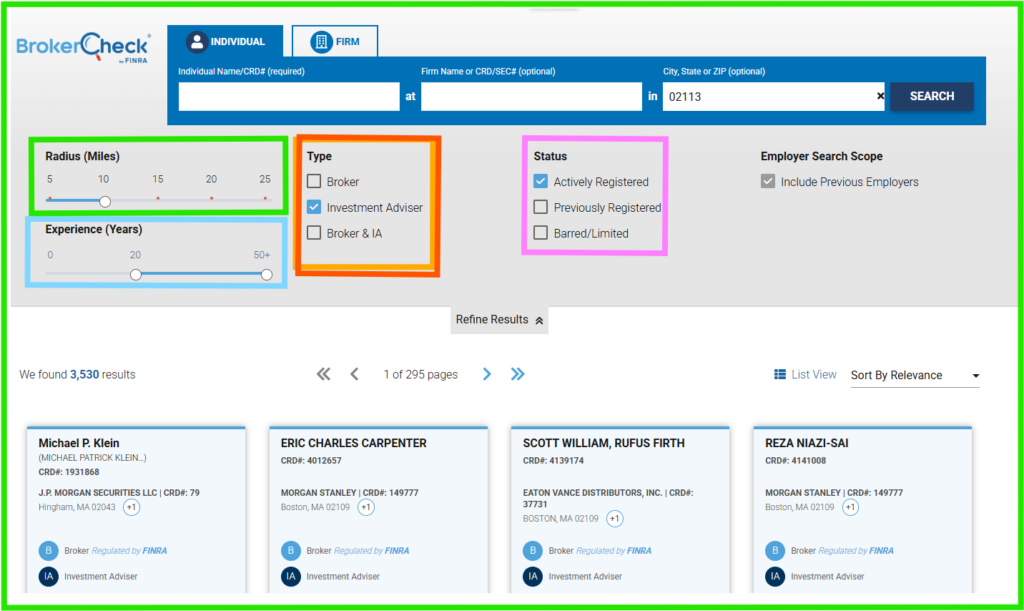

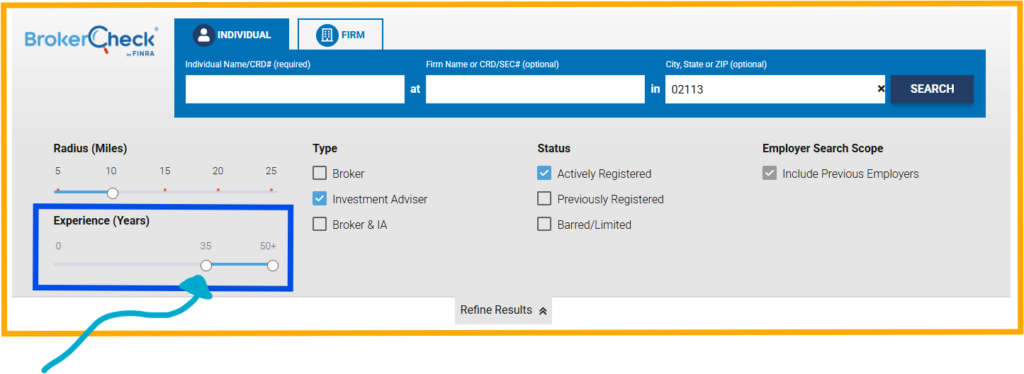

Let’s search by location:

(1) We will search for individuals with a zip code for the City of Boston, MA: 02113.

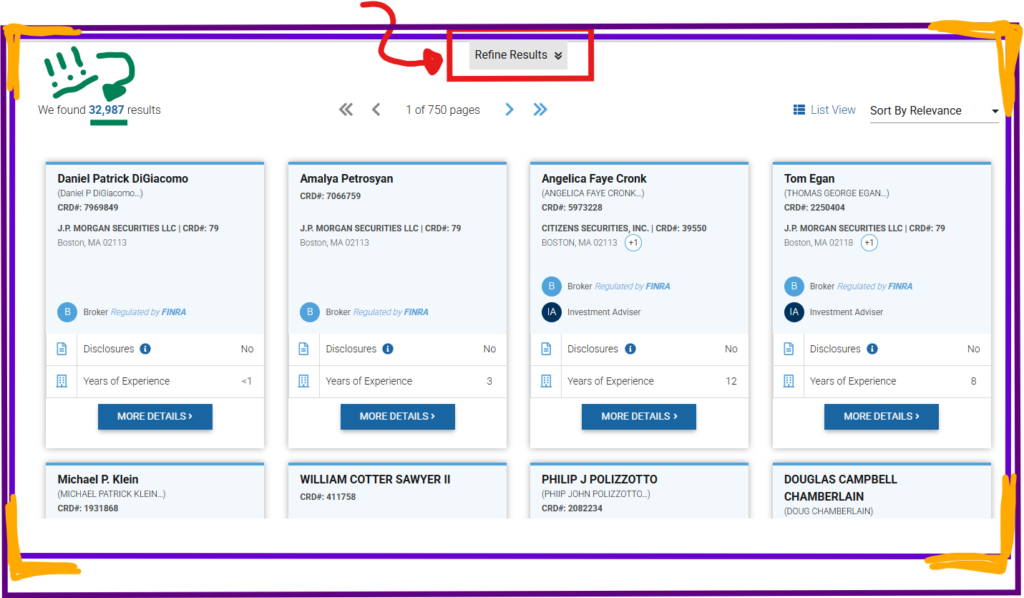

(2) Let’s narrow the large results:

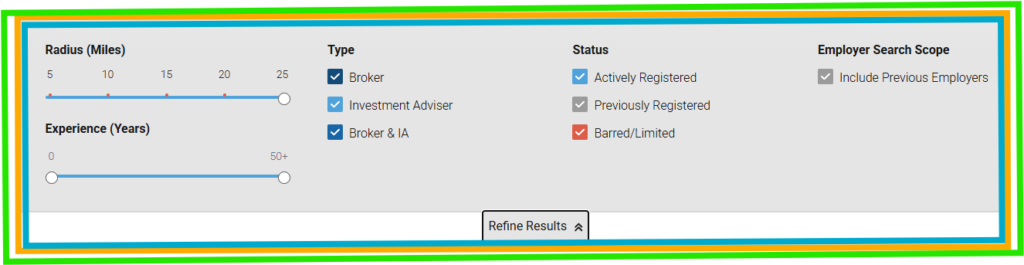

(3) Click on Refine Results (see image above):

(4) Let’s look for “Investment Advisers” within a 10-mile radius of 02113 with 20+ years of experience who are actively registered:

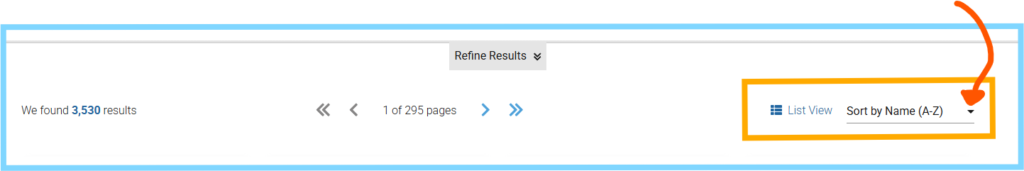

(5) Now, lets sort through the list by name:

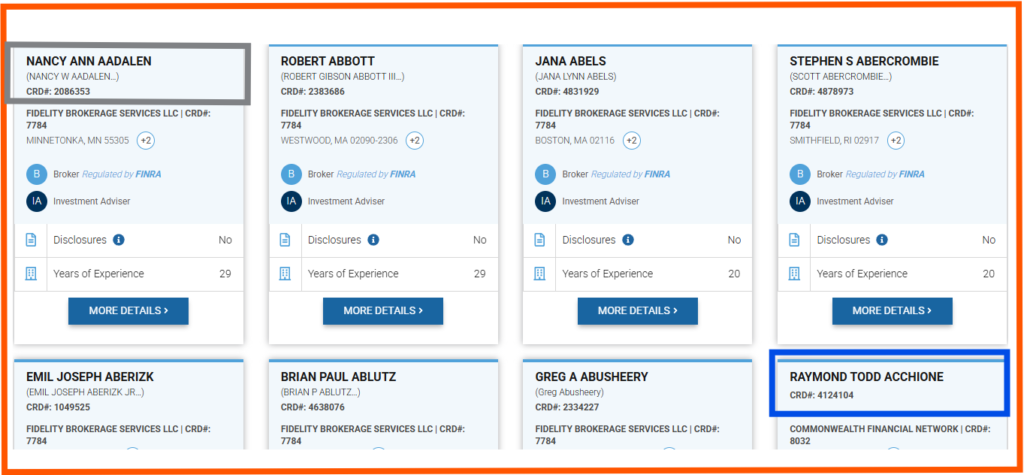

(6) The “Sort By Name (A-Z)” focuses on sorting the individual’s last name:

(7) Narrow the search further: Increase the experience to 35+ years.

(8) We are left with a few hundred individual Investment Advisors within a 10 mile radius of 02113 in Boston:

Congratulations! Don’t be afraid to explore more ways to search.

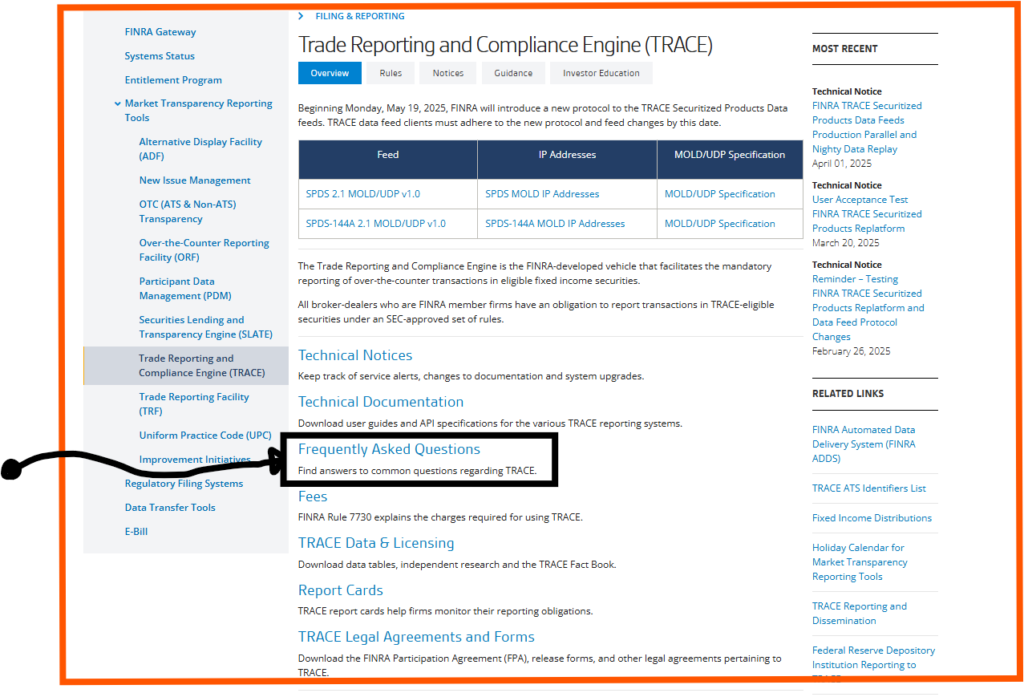

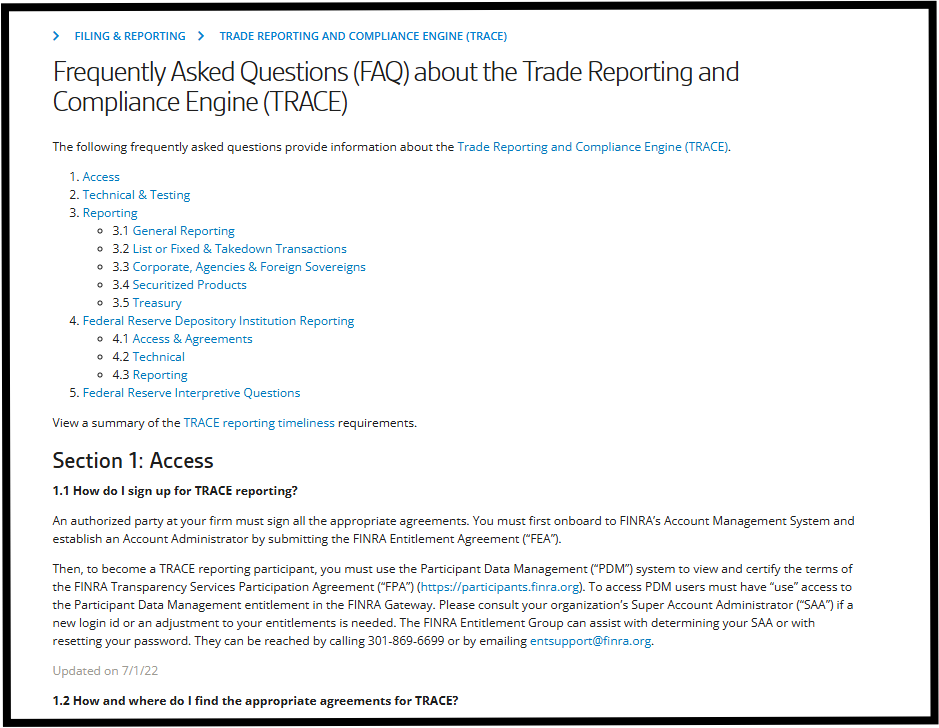

Trade Reporting and Compliance Engine (TRACE)

FINRA’s utilizes the Trade Reporting and Compliance Engine (TRACE) as a vehicle to report over-the-counter transactions in certain eligible fixed income securities.9

FINRA member broker-dealer firms have a mandatory reporting requirement for TRACE-eligible securities transactions.

Let’s navigate to the FAQ section of the TRACE homepage.

“When it is in your power, don’t withhold good from the one it belongs to.

Don’t say to your neighbor, ‘Go away! Come back later. I’ll give it tomorrow” —when it is there with you.

Don’t plan any harm against your neighbor, for he trusts you and lives near you.”

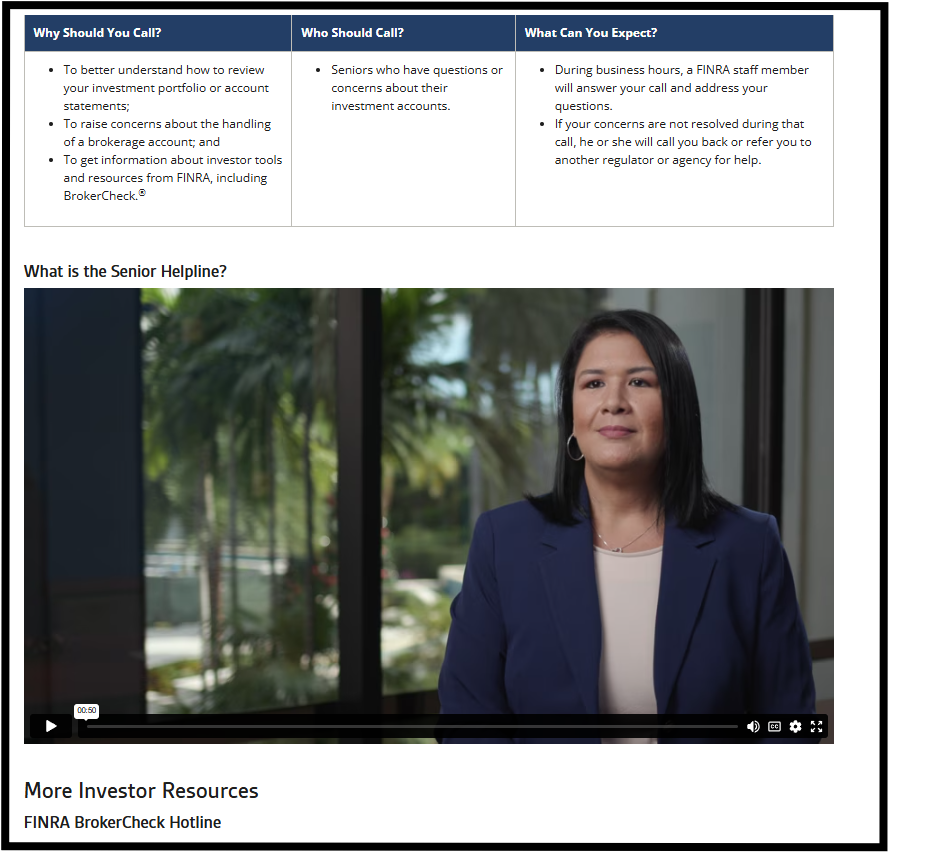

Securities Helpline for Seniors

FINRA has a Securities Helpline for Seniors at 844-57-HELPS (844-574-3577).

FINRA recommends that seniors should call the helpline if: (1) a senior needs help reviewing their investment portfolio or account statement, (2) concerns need to be raised about a brokerage account, and/or (3) to learn information about investor tools & resources.

A FINRA staff member should be available to help during business hours. If the call is not able to be resolved, FINRA will likely refer to another agency/regulator to further assist.

The FINRA Board of Governors

FINRA is governed by a Board of Governors10. The Board of Governors helps ensure a system of checks & balances occurs.11

The current FINRA CEO, Robert W. Cook, has been a Governor since 2016.

The Board of Governors consists of 22 total members seats. Of these 22 seats, ten seats are for industry members, eleven seats are for public members, and one seat is reserved for the CEO.

The public seat members must have “no material business relationship with a broker-dealer or SRO.”12 Different size firms are represented within the ten industry member seats.

In most cases, governors do not serve more than two consecutive terms. Some governors are appointed, while others are elected.

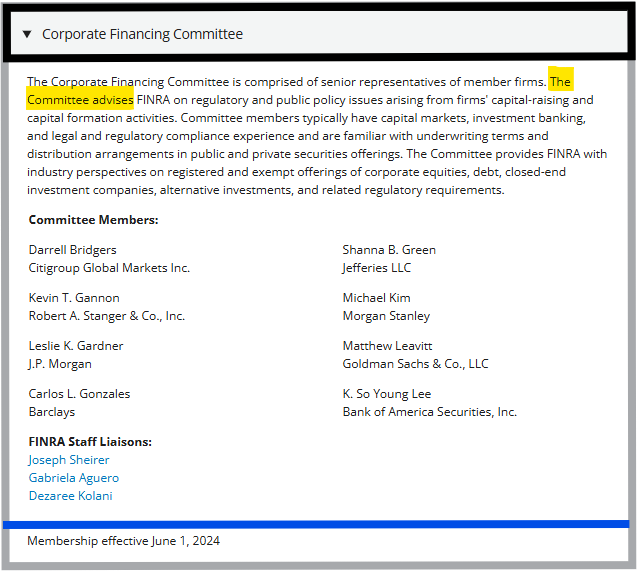

FINRA Committees:

FINRA utilizes advisory committees, regional committees, and ad hoc committees to provide feedback, proposals, and emerging concerns.13

FINRA Advisory Committees:

At the moment, FINRA has 12 advisory committees that provide feedback on mission-critical issues. These advisory committees are composed of both industry members & non-industry members.

- Clearing Firm Advisory Committee

- Corporate Finance Committee

- Economic Advisory Committee

- Financial Responsibility Committee

- Fixed Income Committee

- Investor Issues Committee

- Large Firm Advisory Committee

- Market Regulation Committee

- Membership Committee

- National Arbitration and Mediation Committee

- Small Firm Advisory Committee

- Uniform Practice Code Committee

Proverbs 3:19

(HCSB): “The LORD founded the earth by wisdom and established the heavens by understanding.”

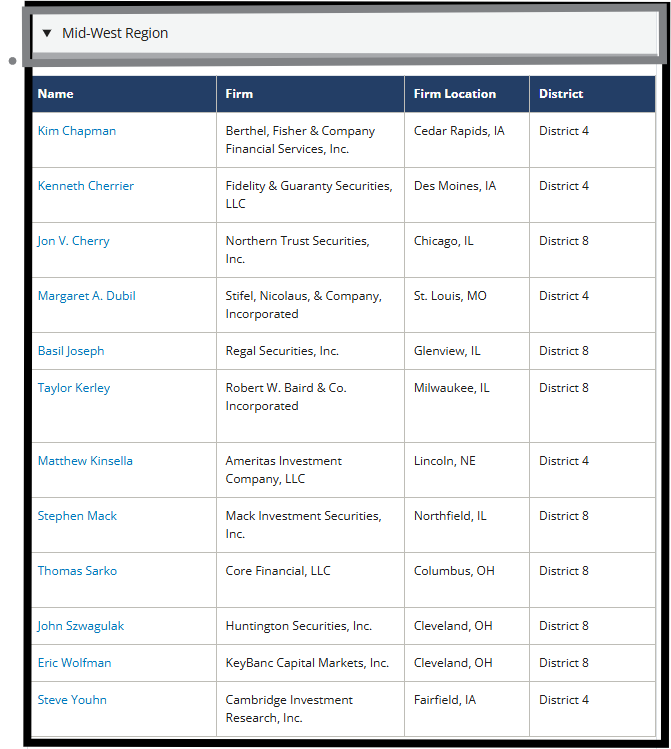

FINRA Regional Committees:

FINRA has Regional committees that advise on regulatory concerns & industry impacts within various regions for their regional constituents.

The Regional Committee membership does take comments & questions on FINRA regulatory programs through email directed at your specific regional committee member.

Regional Committees are divided into five Regions: (1) West, (2) Midwest, (3) South, (4) North, and (5) New York.

Here is an example of Regional Committee members from the Mid-West Region:

FINRA Ad Hoc Committees:

FINRA creates ad hoc committees to consult on specific subject areas.

Recent Ad Hoc committees include:

- Complaints Initatives Committee (CIC)

- FinTech Industry Committee

- Licensing & Registration Council (LRC)

- Public Communications Committee

- Rule 4210 Committee

These Ad Hoc committees can have varying meeting frequencies, structures, & personnel compositions, which vary on the need of the committee.

For example, the Licensing & Registration Council (LRC) is composed of ten industry members, five NASAA members, & two SEC observers who advise FINRA’s CRED department over licensing & registration issues of firms & associated representatives.

The Rule 4210 Committee consists of firms & representatives from organizations like the SEC, Board of Governors of the FED, Cboe, & Operations Clearing Corporation.

The Rule 4210 Committee advises FINRA on issues & changes relating to margin & credit requirements.

(KJV): ” The curse of the LORD is in the house of the wicked: but His secret is with the righteous.”

(LBLA): “ La maldición de Jehová está en la casa del impío; Mas él bendecirá la morada de los justos.”

(AMP): “The curse of the LORD is on the house of the wicked, But He blesses the home of the just and righteous.”

FINRAs History

Self-Regulatory Organizations have governed the U.S. securities industry since the 1790s14.

Member self-governance grew from 1790-1890 with the establishment of regional stock exchanges like the New York Stock Exchange (NYSE).

These regional stock exchanges established rules for their members.

The Investment Banker Association of America states that by 1929, 16 states had semi-uniform blue sky laws.15

In 1933 & 1934, as a response to the events of—the stock market collapse of 1929 & The Great Depression—Congress enacted both the (1) Securities Act of 1933 & (2) Securities Exchange Act of 1934.16

The Securities Exchange Act of 1934 enacted the SEC.

The SEC is the federal regulatory agency responsible for overseeing important aspects of the securities industry & exchanges like the NYSE. It is vital to remember that the SEC is a government agency, whereas FINRA is a private, non-governmental SRO. 17

Regional exchanges remained popular; however, securities trading started growing in “informal networks of securities dealers” outside of these regional exchanges.18

In 1938, the federal Maloney Act empowered the SEC to regulate the informal network of securities dealers by requiring the associations to register with the SEC. The 1938 Maloney Act amendments to the Securities Exchange Act of 1934 created & organized the National Association of Securities Dealers (NASD).19

NASD was organized as a self-regulatory organization (SRO); similar in structure to FINRA but with some differences.20

In fact, the way industry & public member representatives exist on the Board of Governors & how they are voted in was how FINRA responded to problems the NASD faced.

“Some have criticisied, perhaps some still do, the kind of regulation envisioned here, in view of the Commission’s supervisory powers.

Yet they could hardly have expected repeal of the Securities Exchange Act as it relates to our business, and that is what an unspervised form would have represented.

Let us be realistic.

We have an opportunity here to set up our rules of business conduct under a system of business penalties — far preferable, is it not, to Commission regualtions covering the same field, enforceable through criminal penalties.

The process, I think you will find, is parallel to the governmental supervision now existing over the stock exchanges.

Governmental controls, moreover, must provide the essential safeguards to prevent discriminatory, monopolistic, or other unfair tendencies.”21

In 1939, (NASD) was officially registered with the SEC.

Members of NASD had to “observe high standards of commercial honor and just and equitable principles of trade.”22

Customer funds were starting to become protected from misuse as the NASD was empowered by the SEC with enforcement provisions. Some members found liable of misuse were expelled & fined by the NASD under the supervision of the SEC.

The NASD regulated exchanges like: Nasdaq, AMEX, & the ISE.23 However, the NYSE also had regulation abilities & occasionally, the two regulators had inconsistent rules.24

Around July 30th, 2007, NASD combined with aspects of the NYSE to become FINRA. 25

Both the NASD & FINRA believe in just & equitable principles of trade.

FINRA has grown beyond NASD capabilities to regulate an evolving & technologically advanced market to ensure that “everyone can invest with confidence.”

“Happy is a man who finds wisdom and who acquires understanding, for she is more profitable than silver, and her revenue is better than gold.

She is more precious than jewels; nothing you desire compares with her.”

FINRA’s current Chief Legal Officer (CLO), Robert Colby was interviewed by The RMA Journal in May 2019.26

While Mr. Colby’s views do not officially represent the views of FINRA, they can be helpful, nonetheless.

Mr. Colby believes if FINRA ever strays from it’s mission to protect American investors, then FINRA will have lost it’s way.

Mr. Colby believes that FINRA fills in the gaps for the framework that the SEC writes.

Mr. Colby believes the FINRA rules are written to represent all spectrums of organizations & businesses. Mr. Colby believes that while FINRA does spend a fair bit of time on brokers & firms with a history of misconduct, the vast majority of organizations do not fall into that category.

Mr. Colby warns against firms misunderstanding inverse leveraged ETFs & ETPs as they “deteriorate on a daily basis”.27 Additionally, Mr. Colby states that FINRA exists to keep a watch on companies that try to stay one step ahead of the regulators, as these companies are not focused on the customer.

Mr. Colby addresses the need for FINRA’s arbitration program as many “firms impose mandatory arbitration clauses.”28 It is worth noting that FINRA does not control the rules & legalities of arbitration; these are primarily handled by Congress, the Courts, & the Federal Arbitration Act.

However, Mr. Colby states that FINRA will expel a firm/broker who doesn’t pay an arbitration award, if the award is properly justified. FINRA even keeps a watch on firms that owe arbitration awards and try to transfer their assets to another firm before paying out the outstanding award.

Mr. Colby mentions that FINRA is looking to expand upon its rules that allow for firms to supervise their representatives outside business activity. According to Colby, many firms are requesting an increased ability to tell their employees that certain outside activities are not allowed.

Mr. Colby further addresses FINRA’s plan to watch FINRA members that participate in ” cryptocurrency, securization of tokens, blockchain, and other distributed ledger activities.”29

Mr. Colby addresses defining a recommendation from FINRA’s perspective. He belives a recommendation is “a call to action.”30 Certain statements like “These securities deserve your consideration, and you would be remiss to not consider having some of them in your portfolios” may qualify as recommendations. When this line is crossed, then a suitability obligation is imposed.

(WEB): “Trust in Yahweh with all your heart, and don’t lean on your own understanding. In all your ways acknowledge Him, and He will make your paths straight.”

(KJV): “Trust in the LORD with all thine heart; and lean not unto thine own understanding. In all thy ways acknowledge Him, and He shall direct thy paths.”

(LBLA): “Confía en el Señor con todo tu corazón, y no te apoyes en tu propio entendimiento. Reconócele en todos tus caminos, y Él enderezará tus sendas.”

- https://www.finra.org/rules-guidance/notices/07-47#:~:text=On%20July%2030%2C%202007%2C%20NASD%20changed%20its%20name%20to%20FINRA%20and%20changed%20its%20Internet%20domain%20from%20www.nasd.com%20to%20www.finra.org.%20On%20September%2017%2C%202007%2C%20FINRA%20submitted%20proposed%20rule%20change%20SR%2DFINRA%2D2007%2D14%20to%20amend%20IM%2D2210%2D4%20to%20reflect%20the%20new%20corporate%20identity. ↩︎

- FINRA: “About FINRA” ↩︎

- FINRA: “About FINRA” ↩︎

- “FINRA arbitrators deny Stifel’s raiding claim, order firm to pay $7 million in legal fees” ↩︎

- FINRA: “How FINRA Serves Investors and Members” ↩︎

- FINRA: “Central Registration Depository (CRD)” ↩︎

- IAPD ↩︎

- https://brokercheck.finra.org/ ↩︎

- TRACE ↩︎

- FINRA: “FINRA Board of Governors” ↩︎

- Checks & Balances ↩︎

- FINRA: “FINRA Board of Governors” ↩︎

- FINRA: Committees ↩︎

- FINRA: “Our History” ↩︎

- “The Over-The-Counter Market And The Maloney Act” — Speech in 1938 by Francis A. Bonner, p.2 ↩︎

- Investor.gov: “The Laws That Govern the Securities Industry” ↩︎

- FINRA vs. SEC: Business Insider Article ↩︎

- FINRA: “Our History” ↩︎

- NASD History ↩︎

- https://www.sechistorical.org/museum/galleries/sro/sro06g.php ↩︎

- “The Over-The-Counter Market And The Maloney Act” — Speech in 1938 by Francis A. Bonner at the Annual Convention of the Investment Bankers Association of America held at the Greenbrier Hotel in White Sulpher Springs, West Virginia. ↩︎

- NASD: FINRA History ↩︎

- https://www.sechistorical.org/museum/galleries/sro/sro06g.php ↩︎

- https://www.sechistorical.org/museum/galleries/sro/sro06g.php ↩︎

- https://cdn.ca9.uscourts.gov/datastore/library/2013/02/26/Sacks_FINRA.pdf ↩︎

- Interview with Robert Colby ↩︎

- Interview with Robert Colby ↩︎

- Interview with Robert Colby ↩︎

- Interview with Robert Colby ↩︎

- Interview with Robert Colby ↩︎

Leave a Reply