(NIV): “The wisdom of the prudent is to give thought to their ways, but the folly of fools is deception.

(NLT): “The prudent understand where they are going, but fools deceive themselves.”

(ESV): “The wisdom of the prudent is to discern his way, but the folly of fools is deceiving.”

Sources:

(1) Rice S., SIE Exam 2025/2026 For Dummies, 4th Ed. (2024).

(2) https://www.investor.gov/introduction-investing/investing-basics/investment-products/bonds-or-fixed-income-products-0

(3) https://www.investor.gov/introduction-investing/investing-basics/investment-products/bonds-or-fixed-income-products/bonds

(4) https://investor.vanguard.com/investor-resources-education/understanding-investment-types/municipal-bonds

(5) https://www.investopedia.com/terms/g/generalobligationbond.asp

(6) https://www.msrb.org/Municipal-Bond-Basics

(7)https://www.investopedia.com/terms/r/revenuebond.asp#:~:text=A%20revenue%20bond%20is%20a,by%20a%20specified%20revenue%20source.

(8) https://www.municipalbonds.com/education/introduction-to-a-conduit-bond/

Debt vs. Equity Securities

Bonds are considered debt securities. Bonds are a form of debt/credit, like a loan, that is sold to investors from the issuer.

Bonds, as debt securities, differ from equity securities.

Equity securities, like common stocks, provide ownership of a company. Some equity securities provide voting rights.

Typically, bonds do not provide voting rights & ownership of governments & companies.

Municipal bonds

Municipal bonds are debt securities issued by either states, cities, county governments, or United States territories. Municipal bonds, being more local, tend to impact our lives more than federal U.S. government bonds.

Municipal bonds, typically fund obligations & capital projects like schools, highways, fire departments, and other government ventures.

Additionally, municipal bonds provide a mechanism for the government to set their own lending terms (maturity date, interest payments, interest rate) that it may fail to receive from a typical lending institution (bank, credit union, etc…).

Most municipal securities issued after July 3, 1995 are required to file certain information with the Municipal Securities Rulemaking Board (MSRB).

Maturity Date:

All issued bonds have a maturity date. The maturity date tells you when a bondholder will get paid back for loaning the company/government money.

Par Value:

Par value is the face value of the bond. It is the amount a bond is worth when it is issued.

A bond can be traded for a different price (market price) than it’s par value/face value.

Coupon Rate:

The coupon rate is the annual interest rate paid by the bond until the date of maturity. The coupon rate is expressed as a percentage of par/face value.

Example #1:

If a bond paid semiannual interest and the coupon rate was 5% of a $1000 par/face value, then . . . the annual interest would be $50, paid in two (semiannual) installments of $25, yearly, until the date of maturity.

Example #2:

If a bond paid annual interest & the coupon rate was 3% of a $1,000 par/face value, then . . . the annual interest payment would be one payment of $30, yearly, until the date of maturity.

Example #3:

If a bond paid semiannual interest and the coupon rate was 7% of a $1000 par/face value, then . . . the annual interest payment would be $70, paid in two (semiannual) installments of $35, yearly, until the date of maturity.

In many cases, the coupon rate won’t change after that particular bond is issued.

Market Price:

The amount the bond is worth on the secondary market (stock market). This is not the same as the par value.

Market price can be influenced by a variety of factors like inflation, interest rate, if the bond is callable or convertible, etc . . . .

(ESV): “The backslider in heart will be filled with the fruit of his ways, and a good man will be filled with the fruit of his ways.”

(NKJV): “The backslider in heart will be filled with his own ways, But a good man will be satisfied from above.”

(NASB): “One with a wayward heart will have his fill of his own ways, But a good person will be satisfied with his.”

Taxes On Municipal Bonds

Whereas, a corporate bond’s interest is subject to federal, state, and local taxation; interest earned on a municipal bond is likely exempt from federal income tax. However, the municipal bond owner may still be subject to state & local taxation.

Residence tax rule: In some instances, the interest earned on a municipal bond may be exempt from state & local taxes if you reside in the state from which the municipal bond was issued. However, these exemptions are not a guarantee for every municipal bond.

U.S. Territory bonds & taxes: The municipal bonds from U.S. territories of American Samoa, Guam, Northern Mariana Islands, Puerto Rico, and the US Virgin Islands are always tax-free on the interest for the investor. This is true even if the investor of these U.S. Territory municipal bonds do not live in the territory. This means interest earned from municipal bonds issued by U.S. territories are federal, state, and local tax-free, regardless of residency.

Common Types of Municipal Bonds

(1) General Obligation Bonds:

General Obligation (GO) bonds tend to fund nonrevenue-producing facilities like schools, libraries, police departments, and fire stations. These projects typically do not have ways to produce revenue to help pay off the bond.

General Obligation (GO) bonds are backed by the taxing power of the people living inside the state, county, city, or territory the bond was issued within. Because they are supported by the full faith & credit of that municipality, and therefore the taxes of the local people, those same taxpayers often have the right to vote on issuing a GO bond for a project. GO bonds are not backed by collateral.

GO bonds are specified as either limited or unlimited. A limited-tax GO bond has a statutory limit on the raising of property taxes within the municipality. An unlimited-tax GO bond can raise property taxes up to 100% of any delinquency from the municipality tax payers.

(2) Revenue Bonds:

Revenue bonds are backed by revenues from projects like toll roads, bridges, airports, colleges, hospitals, stadiums, etc. . . . Typically, revenue bonds utilize these project as sources of revenue to pay the interest & principal, instead of relying on solely on taxes, since they are not funded by taxpayers (like a GO bond).

In some cases, if the revenue stream fails, the bondholders will lose the claim to the revenue source.

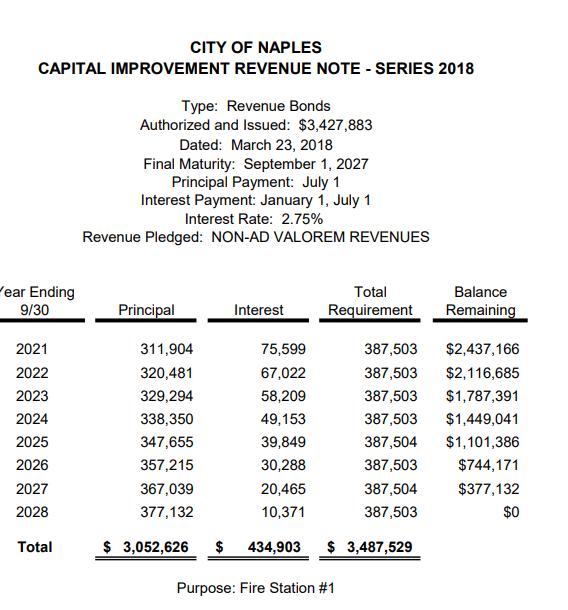

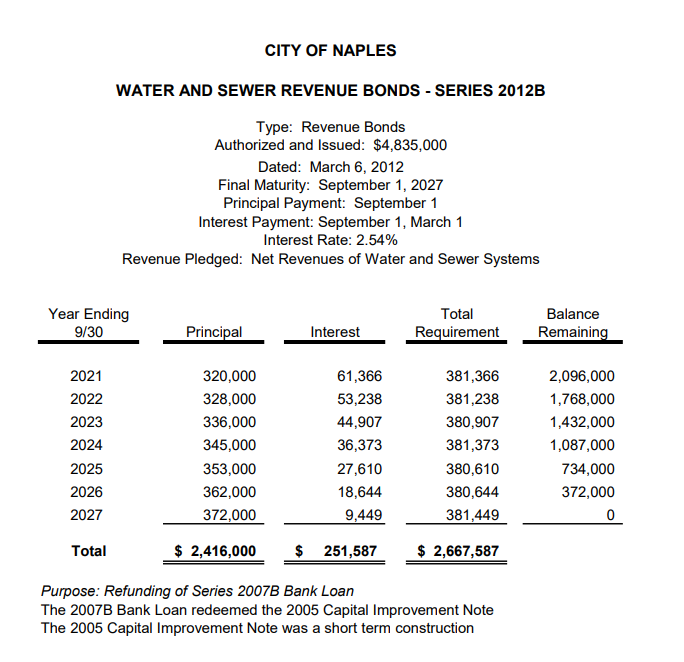

City of Naples Florida, Revenue Bond Examples:

Revenue bonds are considered riskier than GO bonds & thus pay a higher rate of interest. The face value/par value will only be returned if there is sufficient revenue generated from the project.

Many revenue bonds mature in 20 to 30 years. Most revenue bonds are issued with a face value of $1,000 & $5,000. Interestingly, some revenue bonds stagger the maturity date so that they will not mature at the same time.

Revenue bonds allow municipalities to “avoid reaching legislated debt limits.”

(3) Conduit Bonds:

Conduit Bonds have municipal issuers work on behalf of private entities to finance projects like healthcare, housing, and education facilities. Ideally, these private projects will benefit the public good.

The public municipality will act as a conduit on behalf of the private entity but does not promise to guarantee the payment for the bond. Often the public municipality will only coordinate the payments from the issuer.

The private entity, the obligor, has the responsibility to pay interest & return the principal upon the conduit bonds maturity.

Common types of conduit bonds include: (1) Industrial development revenue bonds, (2) private activity bonds, and (3) Housing revenue bonds.

Since the conduit bonds are not backed by municipal assets or taxation methods, they are considered riskier than most other municipal bonds. However, they often generate a higher yield.

Risks of Investing in Municipal Bonds

Every type of security has a unique risk profile. Municipal bonds are no different.

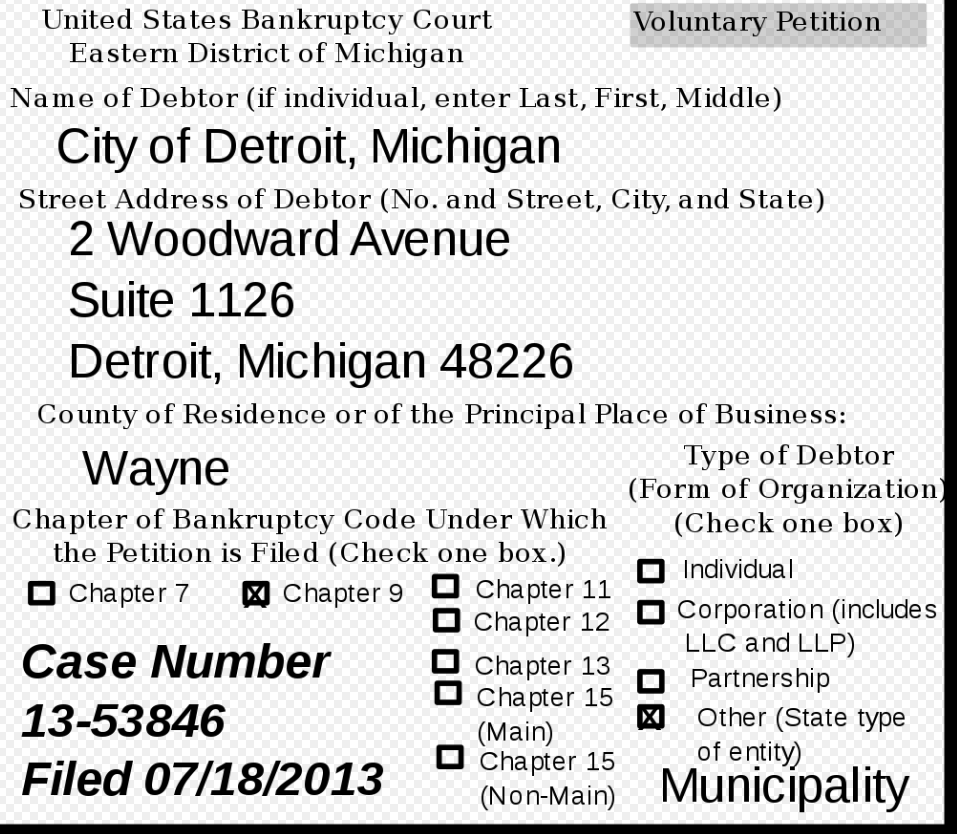

Bankruptcy:

Some municipalities have filed for Chapter 9 bankruptcy. This demonstrates that even municipal bonds have a risk profile.

Below is a list of potential risks undertaken when investing in municipal bonds.

(1) Call Risk:

A call risk is when an issuer repays a bond before it’s maturity date.

Not all municipal bonds are callable, but many are.

Typically, issuers look to repay their bonds before maturity if the interest rates decline. A municipal bond is less likely to be called (paid back by the issuer) if interest rates increase or remain stable.

(!!!): Some municipal bonds (housing bonds & certificates of participation) can be callable at any time the issuer decides. A provision for this feature is often included in the bond’s description as “extraordinary calls” or “subject to extraordinary redemption”.

(2) Credit Risk:

A credit risk occurs when a bond issuer is unable to pay the interest & principal owed to a bondholder. This means the bond issuer defaults.

Some bonds are given a credit rating by a rating agency like Standard & Poor’s (S&P) and Moody’s Investors Services.

(3) Interest Rate Risk:

Bonds often have a fixed par value. When bonds are held to their maturity date, the bondholder will receive the par value + interest due.

Some bonds have a lower fixed-rate interest, that can present issues selling before maturity. This is because the market value of the bond may decrease due to higher U.S. interest rates.

(4) Inflation Risk:

Existing bonds can be impacted by inflation. Inflation causes a general upward movement in prices. Investors investing in bonds with a fixed rate of interest are particularly susceptible inflation risks.

Additionally, inflation can cause higher U.S. interest rates which can negatively impact the market price for bonds sold before maturity.

(5) Liquidity Risk:

Compared to other investment vehicles, investors may struggle to find an active market for the sell of their municipal bond.

Many bondholders do not actively trade their municipal bonds, investors may struggle to trade or purchase a municipal bond at a given price point (compared to more liquid investments), exactly when they want.

(NLT): “A peaceful heart leads to a healthy body; jealousy is like cancer in the bones.”

(KJV): “A sound heart is the life of the flesh: but envy the rottenness of the bones.”

(LBLA): “Un corazón apacible es vida para el cuerpo,

mas las pasiones son podredumbre de los huesos”

Leave a Reply