(HCSB): “For it is God who is working in you, enabling you both to desire and to work out His good purpose.”

(NASB):”[F]or it is God who is at work in you, both to desire and to work for His good pleasure.”

(NKJV): “[F]or it is God who works in you both to will and to do for His good pleasure.”

(KJV): “For it is God which worketh in you both to will and to do of his good pleasure.”

Sources & Inspirations:

The following are sources & inspirations utilized in the creation of this web article. None of these sources, individually, are entirely responsible for the content within.

- Achievable Study Material

- FINRA website material

- FINRA: “Our History”

- Investor.gov: “The Laws That Govern the Securities Industry”

- NASD History

- FINRA + NASD + NYSE Court Document / News Release

- SEC Historical Society: “The Institution of Experience: Self-Regulatory Organizations in the Securities Industry, 1792-2010”

- “The Over-The-Counter Market And The Maloney Act” — Speech in 1938 by Francis A. Bonner, p.2

- https://www.nasdaq.com/glossary/n/national-association-of-securities-dealers

- https://www.sec.gov/rules-regulations/self-regulatory-organization-rulemaking/nasd

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf

- https://bclawreview.bc.edu/articles/2494/files/63e4a6e460d57.pdf

- https://www.tradersmagazine.com/news/nasdaq-a-timeline/

- https://www.wsj.com/articles/SB883094597613998000

- https://www.sec.gov/news/studies/techrp97.htm#:~:text=Executive%20Summary%20*%20The%20Commission%20is%20mindful,state%20and%20international%20regulators%20will%20be%20essential.

- https://www.justice.gov/archive/opa/pr/1996/July96/343-at.html

- https://www.finra.org/sites/default/files/RCA/p002385.pdf

- https://www.nasdaq.com/about/our-people/joseph-r.-hardiman

- https://www.sechistorical.org/collection/papers/1990/1995_1111_HardimanBoca.pdf

- https://www.sechistorical.org/collection/papers/1990/1998_0101_NASDAR.pdf

- https://www.hofstra.edu/pdf/library/libspc_archives_frank_zarb_collection_scrapbook.pdf

- https://www.brownalumnimagazine.com/articles/2007-05-17/the-electronic-trader

- https://www.sec.gov/about/commissioners/mary-l-schapiro

- https://www.sec.gov/rules-regulations#:~:text=Besides%20the%20agency’s%20own%20rulemaking,the%20Municipal%20Securities%20Rulemaking%20Board.

Who Was The National Association of Securities Dealers ?!?

Before FINRA was created, there was the National Association of Securities Dealers (NASD).

The NASD was a non-profit organization selected to comply with the objectives & goals of the Maloney Act amendments to the Securities Exchange Act of 1934.

The NASD had a founding mandate to “standardize the securities industry’s principles & practices, to promote high standards of commercial honor, to advance just and equitable principles of trade for the protection of investors, to adopt and enforce rules of fair practice, and to foster observance by its members of federal and state securities laws.”

The NASD provided for the regulation of the over-the-counter (OTC) securities market. The NASD worked with the SEC & NYSE committees to accomplish this goal.1

Around 1997, the NASD was considered to be the “largest securities industry self-regulatory organization in the United States.2

A History of SROs

Self-Regulatory Organizations (SROs) have governed the U.S. securities industry since 1790.3

These self-regulatory organizations are not governmental, though they may assist the government.

The SEC website creates sub-categories for SROs which include: (1) Joint Industry Plans, (2) National Securities Exchanges, (3) Registered Securities Associations, (4) Notice Registered Securities Future Product Exchanges, (5) Securities Futures Assocations, (6) Registered Clearing Agencies, and (7) Other Self-Regulatory Organizations.4

The SEC categorizes the NASD & FINRA as Registered Securities Associations.

The Securities & Exchange Commission (SEC) oversees most SRO rulemaking functions & oversees other SROs holistically.

Congress has empowered the SEC to monitor & enforce SRO rulemaking functions through acts like the Securities Exchange Act of 1934.

The Securities Exchange Act requires that SROs “create rules that allow for disciplining members for improper conduct and for establishing measures to ensure market integrity and investor protection. SRO proposed rules are subject to SEC review and published to solicit public comment. While many SRO proposed rules are effective upon filing, some are subject to SEC approval before they can go into effect.”5

These are some of the SROs that the SEC oversees: (1) Financial Industry Regulatory Authority (FINRA), (2) the Public Company Accounting Oversight Board (PCAOB), and (3) the Municipal Securities Rulemaking Boarding (MSRB).6

Other important SROs that the SEC enforces rulemaking rules with include the: CBOE, NASDAQ, NYSE, NYSEAMER, CBOT, CME, CFE, NFA, FICC, DTC, OCC, and NSCC.7

The NYSE

Member self-governance grew within the securities industry from 1790-1890 with the establishment of regional stock exchanges like the New York Stock Exchange (NYSE).

These regional stock exchanges helped establish rules for their members.

A Blue-Sky

The Investment Banker Association of America stated that by 1929, 16 states had semi-uniform blue sky laws.8

Blue-sky laws are essentially state security laws.9

Recall that our political framework respects both Federal & State authority and depending on the subject matter (i.e., admirality, immigration, or taxes) & breadth of reach (i.e., inside a state, interstate, national, or global), either authority will have primary control or in some instances, share authority.

Ultimately, security law is both federal & state in nature; however, it is primarily federal.10

However, before the federal acts were enacted in 1933, 1934 and 1938, the states & industry member organizations had main authoritative power over the securities industry.11 Before these acts, Congress utilized the National Industry Recovery Act—until it’s overturn by the Supreme Court case Schechter Poultry Corp v. United States in 1935—& anti-trust laws.12

A Collapse & Depression Occur

In 1933 & 1934, as a response to the events of the stock market collapse of 1929 & The Great Depression, Congress enacted both the (1) Securities Act of 1933 & (2) Securities Exchange Act of 1934.13

These acts, along with the Maloney Act of 1938, would further empower Federal Securities law.

The SEC & Securities Exchange Act of 1934

The Securities Exchange Act of 1934 enacted the SEC.

Recall, The SEC is the federal regulatory agency responsible for overseeing important aspects of the securities industry & SRO exchanges like the NYSE & NASDAQ.14

Regional exchanges remained popular; however, securities trading started growing in “informal networks of securities dealers” outside of these regional exchanges.15

The Maloney Act Amendments

The Maloney Act had the intent to “encourage over-the-counter dealers to organize and regulate their activities under governmental supervision.”16

In 1938, the federal Maloney Act empowered the SEC to regulate the informal network of securities dealers by requiring the associations to register with the SEC.17

Creating The NASD

The 1938 Maloney Act amendments to the Securities Exchange Act of 1934 created & organized the National Association of Securities Dealers (NASD). The NASD was the only securities industry association “established under the Maloney Act amendments.”18

NASD was organized as a self-regulatory organization (SRO); similar in structure to FINRA but with some differences.

The NASD Composition & Organization

The NASD had “a parent corporation” that set “the overall strategic direction and policy agendas of the entire organization” and ensured “that the organization’s statutory and self-regulatory obligations” were completed.19

The NASD parent corporation oversaw at least two subsidiaries: (1) The Nasdaq Stock Market, Inc. & (2) NASD Regulation, Inc.20

The first subsidiary: The Nasdaq Stock Market, Inc., helps the NASD develop, operate, and formulate marketplace systems, services, policies, and listing criteria.

During the NASD’s reign, The Nasdaq Stock Market accounted for 1/2 of all equity trading in the United States each day. Many domestic & foreign companies listed their securities here.21

To learn more about Nasdaq, click here.

The second subsidiary: NASD Regulation, Inc.-helps the NASD achieve various regulatory functions.

NASD Regulation was created around 1996.22 NASD Regulation provided regulatory-legal services like mediation & arbitration to resolve disputes.

The NASD Regulation subsidiary also surveyed markets like The Nasdaq Stock Market & enforced “federal securities laws, the rules of the Municipal Securities Rulemaking Board (MSRB), and NASD rules and regulations.”23

One such large civil-antitrust class-action suit involving thirty Nasdaq member firms & 1,659 stocks around 1994-1997 led to a $910,000,000 settlement.24

Another multi-million settlement occurred around 1996 that involved over 24 firms.25

The SEC Recommends Automation

In 1963, Congress & the SEC undertook a special study of the securities market. The SEC recommended that “the Commission and the NASD should jointly consider possibilities for developing & coordinating automation programs in such manner as to fulfill their respective regulatory needs, as well as operational needs of the markets.”26

The NASD responded by automating vital aspects of their subsidiary, The Nasdaq Stock Market. Bunker-Ramo Corp. was retained to undertake the development of Nasdaq, spending roughly 25 million dollars in 1968.

Early Technology Sparks Growth

In 1993, the NASD, through Nasdaq, implemented Unisys 2200 mainframes that were capable of around 500 transactions per second.27

One such important automated development implemented around 1995-1997, was the StockWatch Automated Tracking (SWAT) system. SWAT recorded bids, offer quotations, and every security trade in the market. SWAT also kept track of the computer from which these occurred on. SWAT had the ability to undertake important data analysis through a system called Research And Data Analysis Repository (RADAR).28

In 1996, Nasdaq.com was launched, becoming a place for investors & issuers to get data on stocks. The website provided critical trading charts & delayed stock quotes of 15 minutes, which was epic.29

In 1998, Nasdaqtrader.com was launched costing the NASD 14 million dollars worth of research & development. This website was designed to help the institutional trader with “contract information, regulations, and . . . technical information.”30

(HCSB): “A wise heart accepts commands, but foolish lips will be destroyed.”

(NASB): “The wise of heart will receive commands, But a babbling fool will come to ruin.”

(NKJV): “The wise in heart will receive commands, But a prating fool will fall.”

(KJV): “The wise in heart will receive commandments: but a prating fool shall fall.”

Early Technology Sparks Growth

On October 30, 1998 the NASD united with the American Stock Exchange. This acquisition brought together a central auction Specialist system in Amex, with a multiple Market Maker system in Nasdaq, creating a “Market of Markets.” Also in 1998, the NASD had 5,592 member firms with 589,120 registered representatives by year-end.31

Who Are The Executives?

The CEO of NASD is considered “the senior leadership position for the NASD” with the “ultimate responsibility for all facets of the organization” like “setting the overall strategic direction & policy agendas . . . being a representative to constituents & the chief spokesperson . . .” for the organization.32

Daniel Patrick Tulley

Daniel Patrick Tully was born in 1932 in Queens, N.Y. Mr. Tully graduated from St. John’s University in 1953 with a Bachelor’s in Business Administration. He served in the United States military from 1953-1955.

Mr. Tully was married to Grace Tully for around fifty-nine years.

Mr. Tully had eight children (four by blood + four by his children’s marriages): Eileen & Paul, Daniel & Dianne, Timothy & Marianne, and Elizabeth & Peter. Mr. Tully also had thirteen grandchildren.

Mr. Tully was eighty-four years old at his passing on May 10th, 2016, while visiting his daughter in Florida.

Mr. Tully spent forty-two years at the large security firm Merrill Lynch, rising from accounting trainee to CEO. He retired as CEO in 1997.

Mr. Tully believed in the five pillars of Merrill Lynch & tried to live his life to those principals: (1) Client Focus, (2) Respect for the Individual, (3) Teamwork, (4) Responsible Citizenship, and (5) Integrity.

He also served as:

- Vice Chairman of the American Stock Exchange

- Vice Chairman of the Securities Industry Association

- Vice chairman of the New York Stock Exchange (NYSE)

- President of the Ireland United States Council for Commerce & Industry

- Commissioner of the National Pensions Reserve Fund

- Chairman of the Tully Commission

- Chairman of Central Park Conservancy’s Wonders of New York Campaign

- Chairman of the NASD

In 2008, Mr. Tully & thirty-one other individuals formed Fieldpoint Private Bank & Trust

Mr. Tully was philanthropic, supporting the Stamford Hospital of Stamford, Connecticut & Tully Health Center. He enjoyed traveling & playing golf. Mr. Tully particularly enjoyed the country of Ireland.

He was known for ending phone calls & meetings with “God bless you. 33

Gordon Macklin

Gordon Macklin was involved in the founding of the NASD. Mr. Macklin served as the NASD President from 1970-1987.

Died of a stroke on January 30th, 2007 at 78 years old. He married Marilyn Macklin & together they had four children. After college, Mr. Macklin joined the securities firm McDonald & Co as a trainee.

In the later 1980’s, after leaving the NASD, Mr. Macklin worked at various securities firms like: Hambrecht & Quist, Inc. & White River Corp. He was involved in various boards like: Overstock, MedImmune, WorldCom, & Spacehab.

Mr. Macklin was involved in philanthropic giving to various educational institutions like Brown University & Montgomery College. 34

Joseph R. Hardiman

Joseph R. Hardiman was elected CEO of NASD in 1987. Mr. Hardiman served NASD for around ten years before retiring on January 31st, 1997. Mr. Hardiman also served as both Chairman & President. Mr. Hardiman was trained as a lawyer at the University of Maryland & engaged in securities & securities law for most of his career.

Mr. Hardiman oversaw Nasdaq market capitalization breaking a trillion dollars in 1995 & Nasdaq creating a ton of jobs in the early 1990s. He also oversaw the formation of NASD as a parent company, becoming a legally separate entity from both of it’s subsidiaries mentioned earlier: (1) NASD Regulation, Inc. & (2) The Nasdaq Stock Market, Inc.35

(HCSB): “A wise heart accepts commands, but foolish lips will be destroyed.”

(NASB): “The wise of heart will receive commands, But a babbling fool will come to ruin.”

(NKJV): “The wise in heart will receive commands, But a prating fool will fall.”

(KJV): “The wise in heart will receive commandments: but a prating fool shall fall.”

Frank G. Zarb

Frank Gustave Zarb was born in Brooklyn, N.Y. on February 17th, 1935. Mr. Zarb married his wife, Patrica Koster, in March of 1957. Mr. Zarb graduated with an M.B.A. from Hofstra College in 1962. Mr. Zarb served more than eight years in the United States Army & US Army Reserve.

Frank G. Zarb was elected CEO of NASD on January 28th, 1997. Mr. Zarb assumed his duties on February 24th, 1997. Mr. Zarb served as CEO before resigning in 2001. After resigning, he continued to hold seats on two of Nasdaq’s international boards of directors.

Before his election to CEO of NASD, Mr. Zarb was: CEO of Alexander & Alexander Services Inc., Vice Chairman of The Travelers Inc., CEO of Smith Barney, a General Partner of Lazard Freres & Co., and was appointed Administrator of the Federal Energy Administration for three years.

Mr. Zarb is Chairman of Frank Zarb Associates, LLC. Mr. Zarb was one of the directors involved in developing Lower Manhattan after the September 11th attacks on the World Trade Center. He is involved in teaching & advising on financial topics & energy policy.36

Mary Schapiro

In 2006 Mary Schapiro, was named Chairman & CEO of NASD. Mrs. Schapiro is responsible for leading the NASD to merge with NYSE Member Regulation & forming FINRA as a result.

Mrs. Schapiro graduated from both Franklin & Markshall College and George Washington University. She earned her J.D. with honors from George Washington. She has served on the boards of various organizations like: Duke Energy, and Franklin & Marshall.

Mrs. Schapiro was appointed to become the 29th Chairman of the SEC. She was appointed by President Obama on January 20th, 2009, confirmed by the Senate & sworn in on Janurary 27th, 2009.

Mrs. Schapiro is the “only person to have served as head of the SEC, the Commodity Futures Trading Commision (CFTC), and the Financial Industry Regulatory Authority (FINRA).”

Before her appointment as the 29th Chairman of the SEC, Mrs. Schapiro was the CEO of FINRA. She joined FINRA in 1996 when she was the President of NASD Regulation (a subsidiary of NASD). 37

What Did The NASD Regulate?

In 1939, the NASD was officially registered with the SEC.

Members of NASD had to “observe high standards of commercial honor and just and equitable principles of trade.”38

Customer funds were starting to become protected from misuse as the NASD was empowered by the SEC with enforcement provisions. Some members found liable of misuse were expelled & fined by the NASD under the supervision of the SEC.

The NASD regulated exchanges like: Nasdaq, AMEX, & the ISE.39 In 1997, the NASD was comprised of over 5,500 securities firms that employed more than 535,000 registered representatives.40

However, the NYSE also had regulation abilities & occasionally, the two regulators had inconsistent rules.41

The SEC has kept a record of previous NASD Rulemaking, and this information can be found here.42 The most recent NASD filed issue with the SEC was on September 14th 2012.

From NASD To FINRA

Around July 30th, 2007, former CEO Mrs. Mary L. Schapiro led the NASD to combine with the NYSE Member Regulation to become FINRA.43

Both the NASD & FINRA believe in just & equitable principles of trade.

FINRA has grown beyond NASD capabilities to regulate an evolving & technologically advanced market to ensure that “everyone can invest with confidence.”

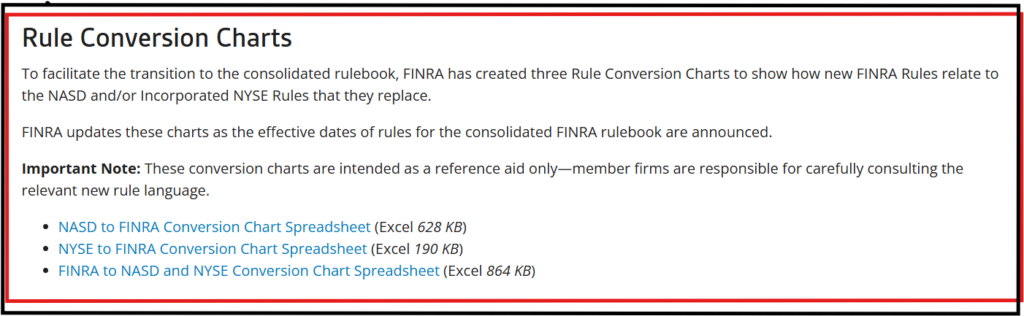

Previous NASD & NYSE rules were ultimately converted/replaced by FINRA rules. These conversion charts can be found here by clicking on the image below:

(HCSB): “When there are many words, sin is unavoidable, but the one who controls his lips is wise.”

(NASB): “When there are many words, wrongdoing is unavoidable, But one who restrains his lips is wise.”

(NKJV): “In the multitude of words sin is not lacking, But he who restrains his lips is wise.”

(KJV): “In the multitude of words there wanteth not sin: but he that refraineth his lips is wise.”

Footnotes:

- https://www.nasdaq.com/glossary/n/national-association-of-securities-dealers ↩︎

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf ↩︎

- FINRA: “Our History” ↩︎

- https://www.sec.gov/rules-regulations/self-regulatory-organization-rulemaking ↩︎

- https://www.sec.gov/rules-regulations/statutes-regulations ↩︎

- https://www.sec.gov/rules-regulations#:~:text=Besides%20the%20agency’s%20own%20rulemaking,the%20Municipal%20Securities%20Rulemaking%20Board. ↩︎

- https://www.sec.gov/rules-regulations/self-regulatory-organization-rulemaking ↩︎

- “The Over-The-Counter Market And The Maloney Act” — Speech in 1938 by Francis A. Bonner, p.2 ↩︎

- https://www.investor.gov/introduction-investing/investing-basics/glossary/blue-sky-laws#:~:text=In%20addition%20to%20the%20federal,brokers%2C%20and%20investment%20adviser%20representatives. ↩︎

- https://www.law.cornell.edu/wex/securities#:~:text=Federal%20law%20primarily%20regulates%20securities,securities%20in%20the%20primary%20market%20. ↩︎

- https://www.sechistorical.org/collection/papers/1930/1938_0617_MemoMaloney.pdf ↩︎

- https://www.sechistorical.org/collection/papers/1930/1938_0617_MemoMaloney.pdf, pp.1-3; https://www.archives.gov/milestone-documents/national-industrial-recovery-act ↩︎

- Investor.gov: “The Laws That Govern the Securities Industry ↩︎

- https://www.sec.gov/rules-regulations/self-regulatory-organization-rulemaking ↩︎

- FINRA: “Our History” ↩︎

- https://bclawreview.bc.edu/articles/2494/files/63e4a6e460d57.pdf, p.187 ↩︎

- NASD History ↩︎

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf ↩︎

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf ↩︎

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf ↩︎

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf, p.4 ↩︎

- https://www.law.cornell.edu/wex/securities#:~:text=Federal%20law%20primarily%20regulates%20securities,securities%20in%20the%20primary%20market%20.https://www.tradersmagazine.com/news/nasdaq-a-timeline/ ↩︎

- https://www.law.cornell.edu/wex/securities#:~:text=Federal%20law%20primarily%20regulates%20securities,securities%20in%20the%20primary%20market%20.https://www.finra.org/sites/default/files/Corporate/p009762.pdf, p.6; https://www.tradersmagazine.com/news/nasdaq-a-timeline/ ↩︎

- https://www.tradersmagazine.com/news/nasdaq-a-timeline/; https://www.naag.org/multistate-case/in-re-nasdaq-market-makers-antitrust-investigation-litigation-94-civ-3996-m-d-l-no-1023-s-d-n-y-1997-169-f-r-d-493-s-d-n-y-1996/; https://www.wsj.com/articles/SB883094597613998000 ↩︎

- https://www.tradersmagazine.com/news/nasdaq-a-timeline/; https://www.justice.gov/archive/opa/pr/1996/July96/343-at.html ↩︎

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf, p.8; https://www.tradersmagazine.com/news/nasdaq-a-timeline/ ↩︎

- https://www.tradersmagazine.com/news/nasdaq-a-timeline/ ↩︎

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf, pp.8-9; https://www.tradersmagazine.com/news/nasdaq-a-timeline/ ↩︎

- https://www.tradersmagazine.com/news/nasdaq-a-timeline/ ↩︎

- https://www.tradersmagazine.com/news/nasdaq-a-timeline/ ↩︎

- https://www.sechistorical.org/collection/papers/1990/1998_0101_NASDAR.pdf; ↩︎

- https://www.finra.org/sites/default/files/RCA/p002385.pdf, p.2 ↩︎

- https://darienite.com/daniel-tully-former-darien-resident-merrill-lynch-executive-for-whom-stamfords-tully-health-center-is-named-10942; https://www.hbs.edu/leadership/20th-century-leaders/details?profile=daniel_p_tully; https://www.investmentnews.com/industry-news/daniel-tully-merrill-lynch-ex-ceo-torn-by-the-firms-fate-dies-at-84/67593 ↩︎

- https://www.brownalumnimagazine.com/articles/2007-05-17/the-electronic-trader; ↩︎

- https://www.finra.org/sites/default/files/RCA/p002385.pdf; https://www.nasdaq.com/about/our-people/joseph-r.-hardiman; https://www.sechistorical.org/collection/papers/1990/1995_1111_HardimanBoca.pdf, pp.3-4 ↩︎

- https://www.finra.org/sites/default/files/RCA/p002385.pdf; https://www.hofstra.edu/special-collections/frank-zarb-collection.html; https://www.hofstra.edu/pdf/library/libspc_archives_frank_zarb_collection_scrapbook.pdf ↩︎

- https://www.linkedin.com/in/maryschapiro/; https://www.sec.gov/about/commissioners/mary-l-schapiro ↩︎

- NASD: FINRA History ↩︎

- https://www.sechistorical.org/museum/galleries/sro/sro06g.php; https://www.finra.org/sites/default/files/Corporate/p009762.pdf ↩︎

- https://www.finra.org/sites/default/files/Corporate/p009762.pdf, p.2 ↩︎

- https://www.sechistorical.org/museum/galleries/sro/sro06g.php ↩︎

- https://www.sec.gov/rules-regulations/self-regulatory-organization-rulemaking/nasd ↩︎

- https://cdn.ca9.uscourts.gov/datastore/library/2013/02/26/Sacks_FINRA.pdf; https://www.sec.gov/about/commissioners/mary-l-schapiro

↩︎

Leave a Reply